Best Forex Brokers in Australia

Our comparison in April 2024 of the 39 ASIC-regulated platforms found Pepperstone to be the best forex broker in Australia. We opened several accounts, ran tests and cross-checked with published data to determine this finding.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Key Strengths

Key Strengths

Ask an Expert

Is forex legal in Australia?

Hi Josh.

Forex trading is very legal in Australia. The most important thing is to choose a broker that i regulated by the Australia Securities and Investment Commission, also known as ASIC.

Using an ASIC regulated broker means the broker complies with the requirements of companies in Australia that manage financial services.

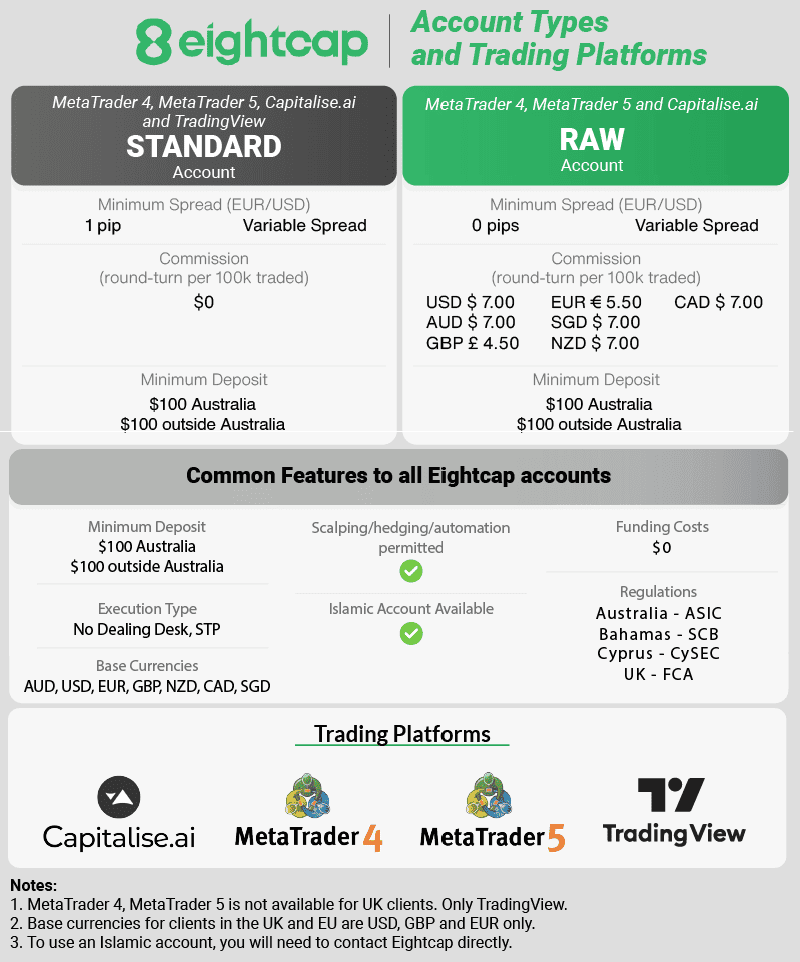

Good brokers ASIC regulated brokers include Pepperstone, IC Markets, FP Markets, Markets.com, IG Markets, Eightcap, BlueBerry Markets,

Should I choose MetaTrader 4 or MetaTrader 5 when opening a demo account?

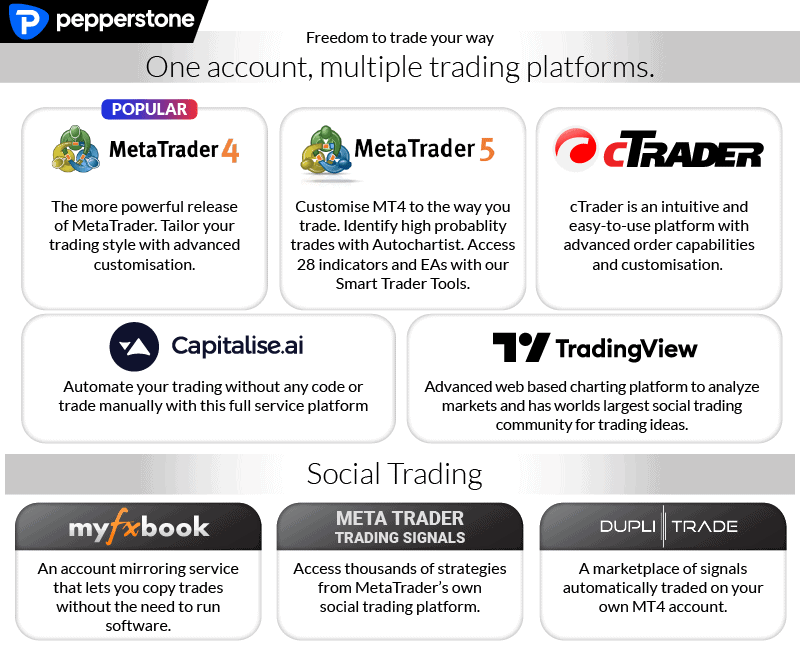

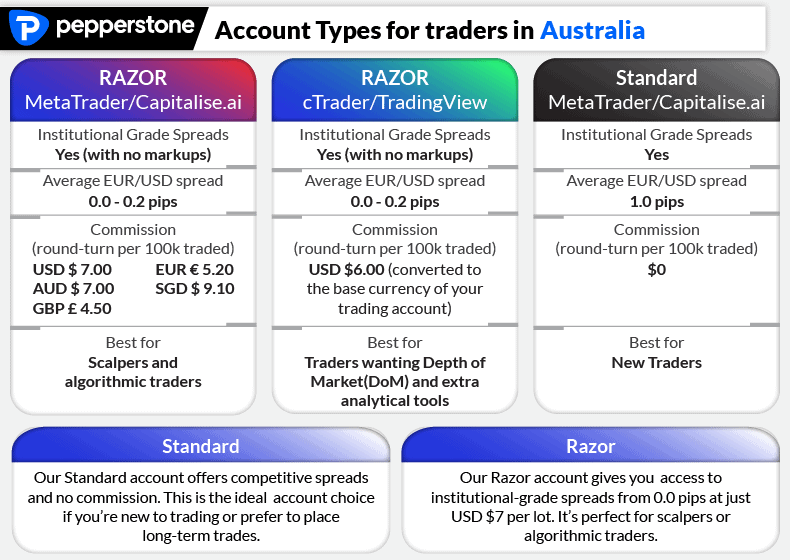

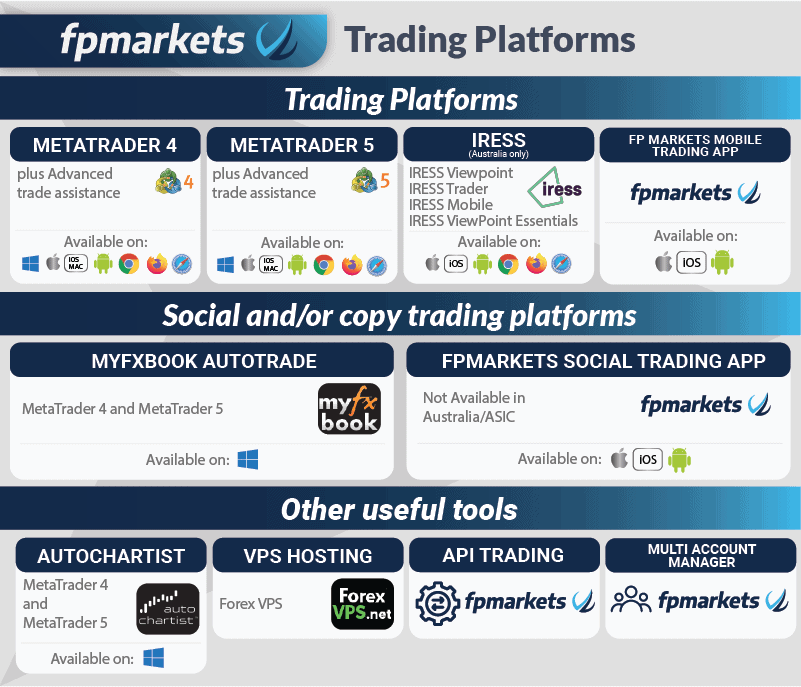

It is best to demo the platform you plan to use when trading. There are and cons of both trading platforms but generally, MetaTrader 5 has all the features MT4 has and more.

The main reason to choose MT4 is if you have a low powered computer since MT5 uses higher processing power, you want access to the largest possible range of expert advisors since MT4 has a larger marketplace, a larger trading community since more people use MT4 and if you plan to use Myfxbook or Duplitrade which integrates with MT4 but not MT5. If you plan to trade stocks then you must use MT5 since MT4 is not built for this.

I’m looking for a high margin Australian broker but they all seem to have the same leverage. Why is this and how do I get more?

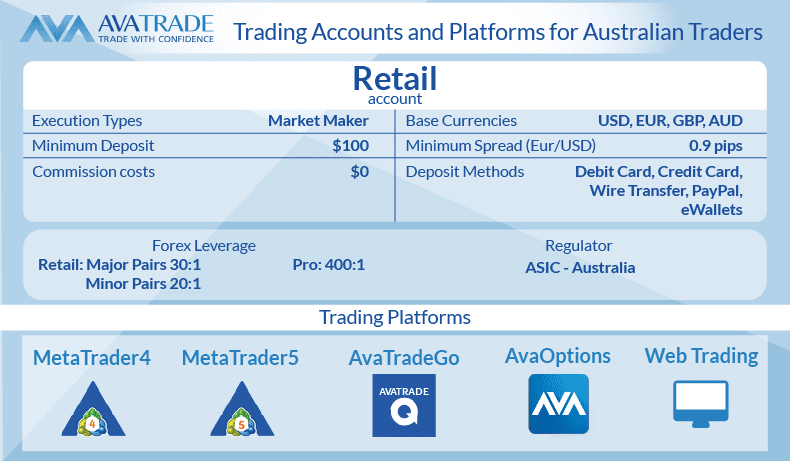

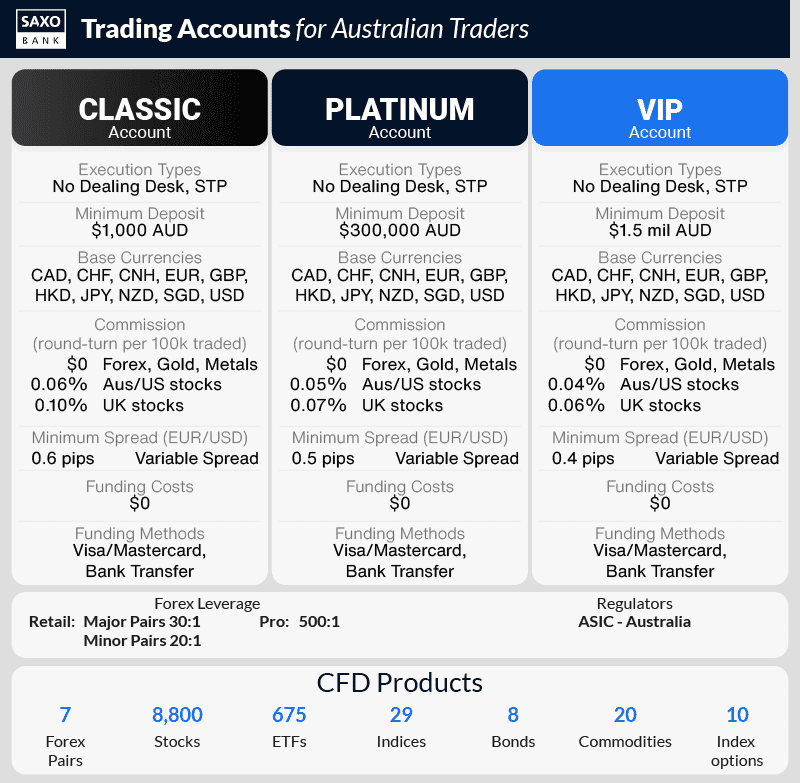

Brokers in Australia must be licenced and regulated by the Australia Securities Investment Commission (ASIC), as a condition of their licence they cannot offer leverage higher than 30:1 for major forex pairs and 20:1 for minor forex pairs. If you want higher leverage, some brokers do offer up 500:1 provided you meet the qualification criteria as a professional trader. To do this you must pass the brokers Sophisticated Investor Test or Wealth test.

I would like to know about decfx, I know they are an Australian broker but I want to know how good they are

Can a broker in Australia with an ASIC license expand their business reach

Yes as long as you abide by ASIC regulatory conditions

What happens with my money sitting in brokers account? Do I get interest?

Your broker will arrange for your funds to be kept in a segregated bank account. This allows you to access the funds for trading quickly and easily without the broker ever being able to access these funds. Since the funds are kept in a bank account, your funds will earn your interest how much this is will depend on the type of account and interest the bank is offering.

When trading you can also earn interests through swaps or overnight fees. If you have an open position and hold this over closing hours (new york time in the case of forex) then you will either pay or earn swaps fees. You can also earn through commissions if you are trading shares.

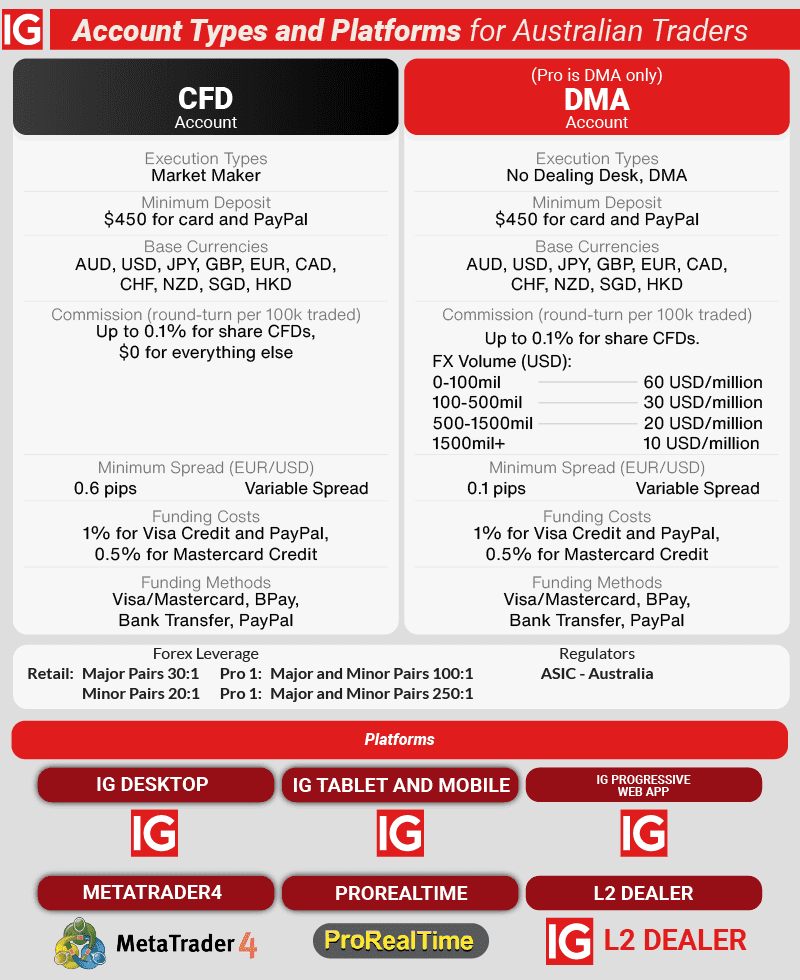

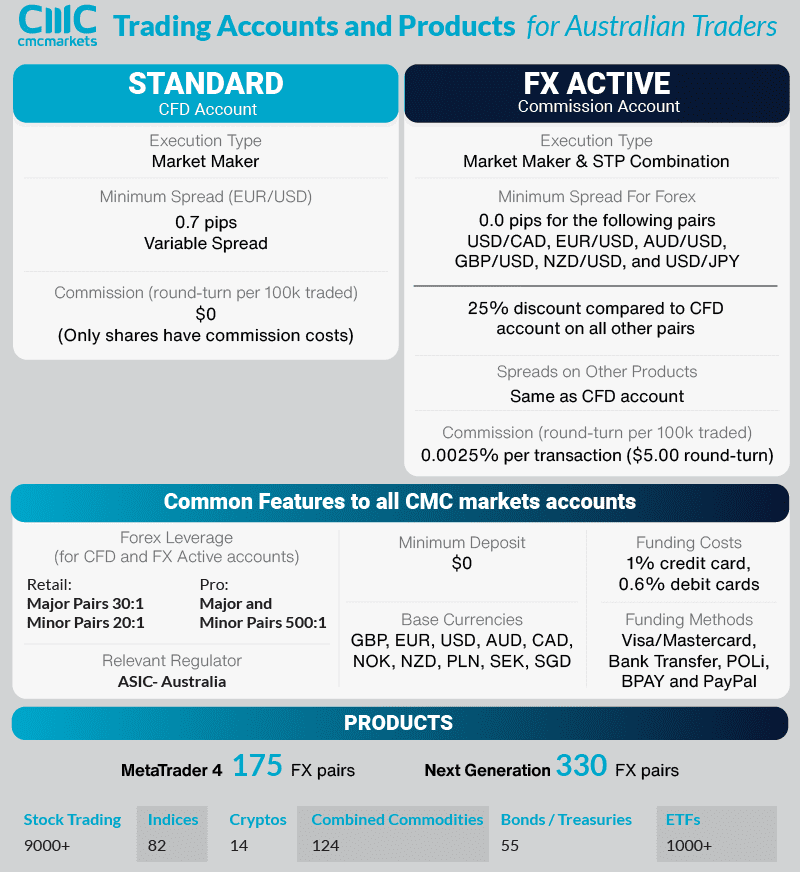

I’m looking to open a share trading account and a forex account. If I join IG or CMC can I have a centralised account or would it mean opening up two different ones?

What is Australia’s largest broker?

Depends how you define largest Largest by size or by trading volumne? Our research suggest IF with 320,000 clients worldwide is the largest by revenue. In terms of trading volume IC Markets is the largest with $22.68 billion in daily turnover.