FXCM Review 2024

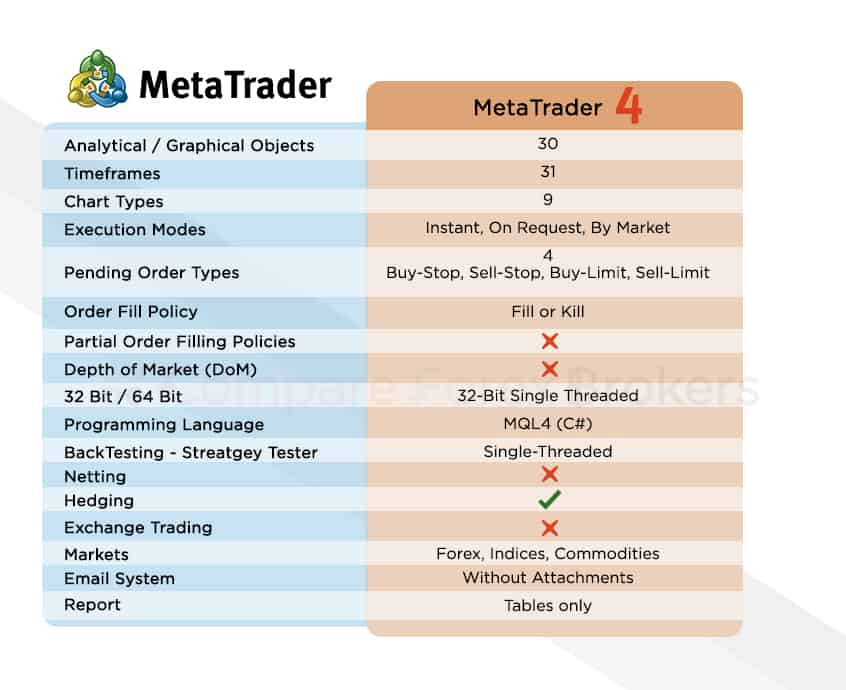

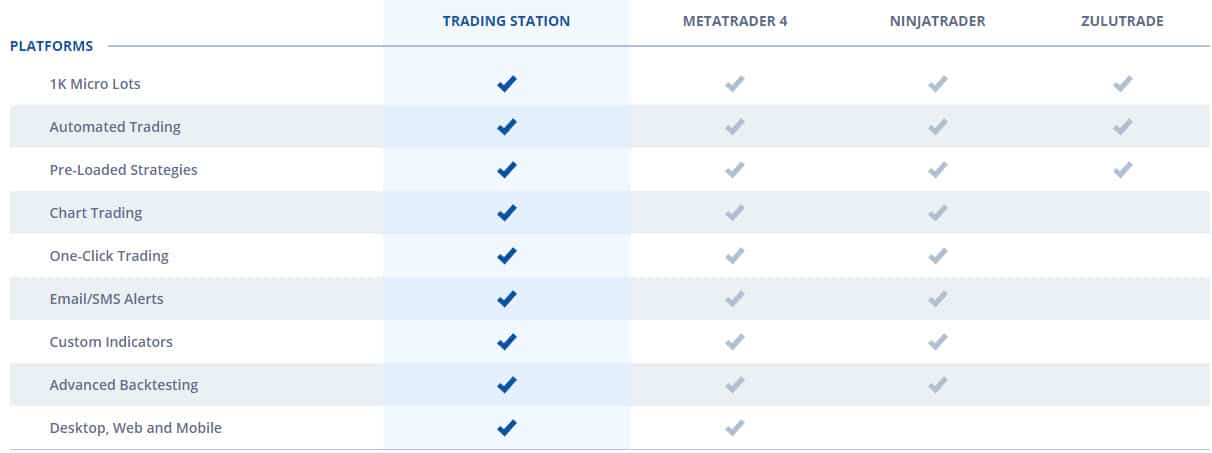

FXCM is an international forex broker that offers leverage1 up to 30:1 for AU, EU, and UK clients while 400:1 for other clients, the choice of the forex trading platforms MetaTrader 4, NinjaTrader, or Trading station, spreads2 from 1.30.4 pips on EUR/USD and zero commissions.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Account Types

Account Types

Spreads

Spreads

Trading Platforms

Trading Platforms

Customer Support

Customer Support

Minimum Deposit

Minimum Deposit

Leverage

Leverage

Forex Pairs + CFDs

Forex Pairs + CFDs

Regulation

Regulation

The FXCM Trading Station forex platform is generally hard to fault, it has a very user-friendly design and comes with has become FXCM’s hub for investment advice. One of the key features of the platform is the free professional charting tool known as Marketscope 2.0 which consists of price alerts, charts and a wide selection of indicators. One of the key features of Marketplace is the ability to open and manage all your trades directly from the charts. This means you can perform all your trading analysis, opportunity identification and order execution all in one place. This simplified trading process makes the platform a great tool for beginner traders.

The FXCM Trading Station forex platform is generally hard to fault, it has a very user-friendly design and comes with has become FXCM’s hub for investment advice. One of the key features of the platform is the free professional charting tool known as Marketscope 2.0 which consists of price alerts, charts and a wide selection of indicators. One of the key features of Marketplace is the ability to open and manage all your trades directly from the charts. This means you can perform all your trading analysis, opportunity identification and order execution all in one place. This simplified trading process makes the platform a great tool for beginner traders.

Ask an Expert