MT4 vs MT5 Comparison

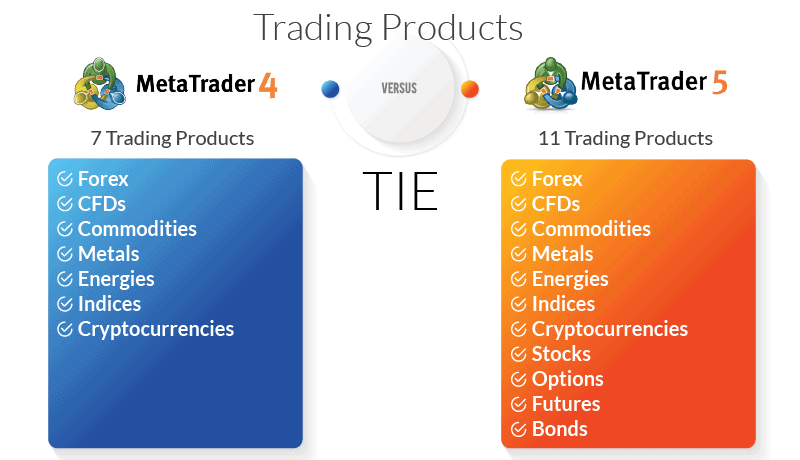

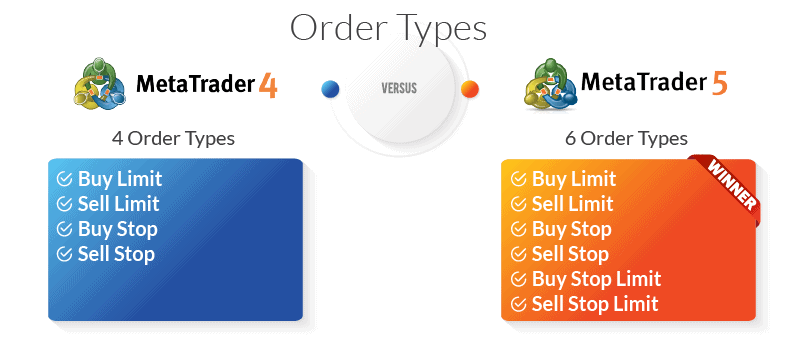

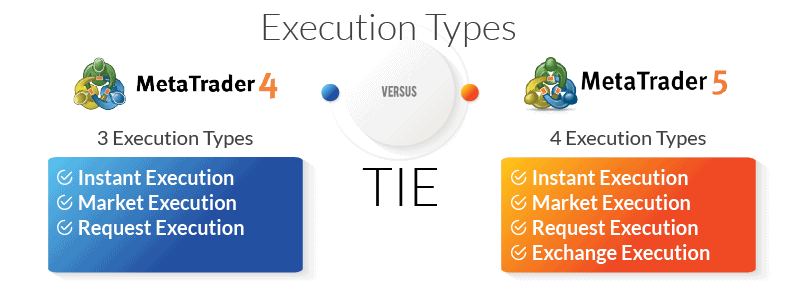

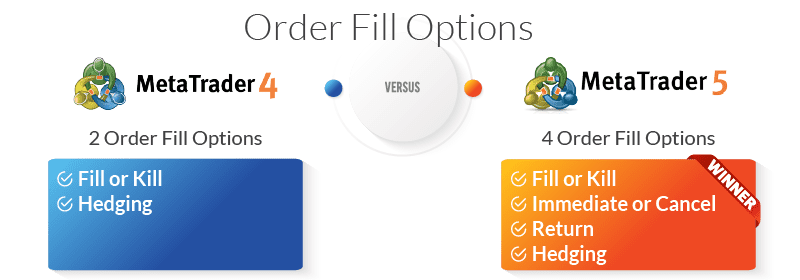

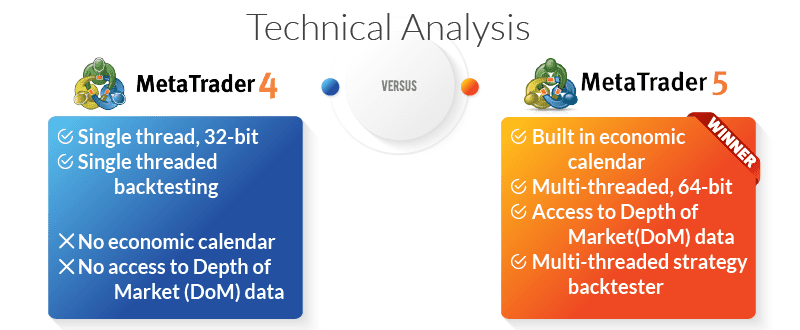

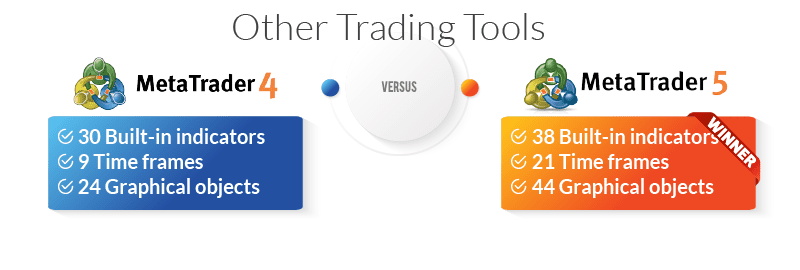

Metaquotes has 2 trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This MT4 vs MT5 forex trading platform comparison found MT4 is most popular with Forex traders while MT5 offers superior features like more charts.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

Does MT5 have automated trading?

Automated trading is possible with MT5 through the use of automated trading applications such as Expert Advisors (EAs). EAs allow you to use trading robots to execute your trades automatically while indicators can automatically analyse price patterns. You can use ready made EAs from the MT5 marketplace or write your own custom EA using MQL5 script.

Can I run MT4 and MT5 together?

Kind of – you will need to have MT4 and MT5 running from a different file on your drive and possible a separate partition.