ThinkMarkets Review 2024

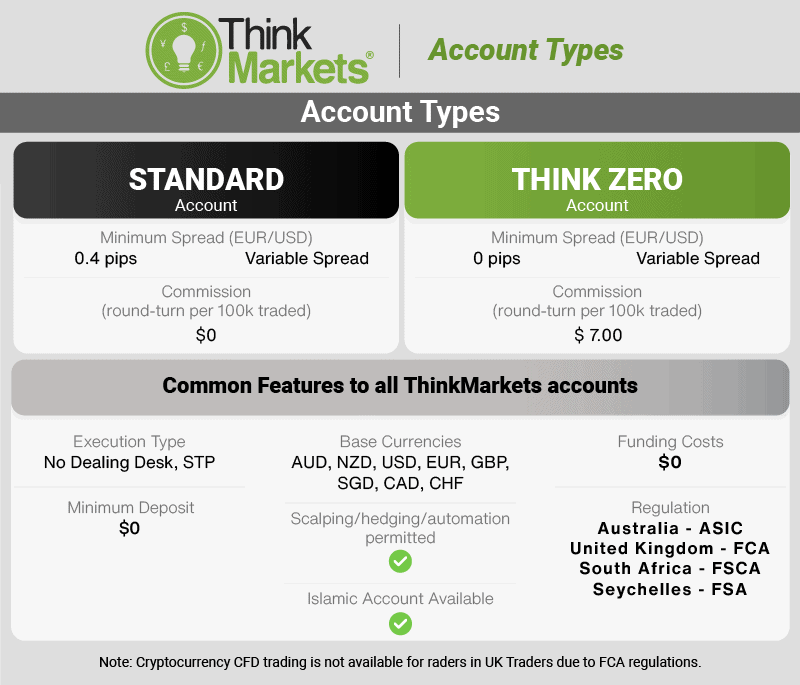

If you’re looking for an STP forex broker with a reputation for tight spreads, then ThinkMarkets is a great option. ThinkMarkets offers 46 currency pairs for forex trading, choice of MetaTrader 4, 5 and ThinkTrader trading platforms and leverage of up to 30:1 (ASIC, CySEC, FCA), up to 25:1 (JFSA) and up to 500:1 (FSA, FSCA)

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Account Types

Account Types

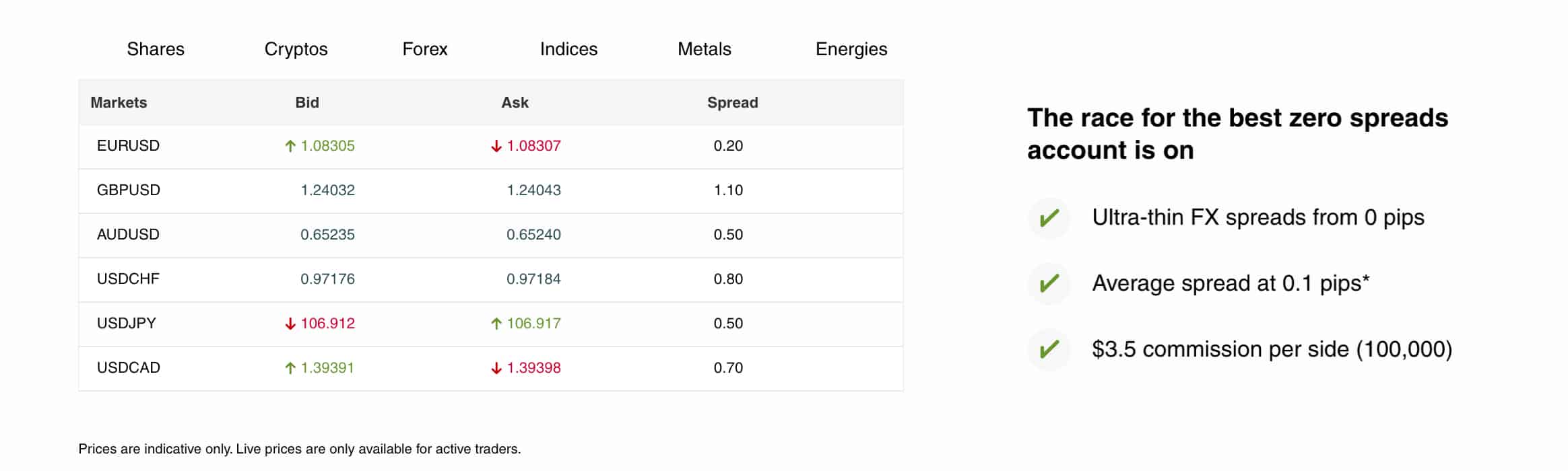

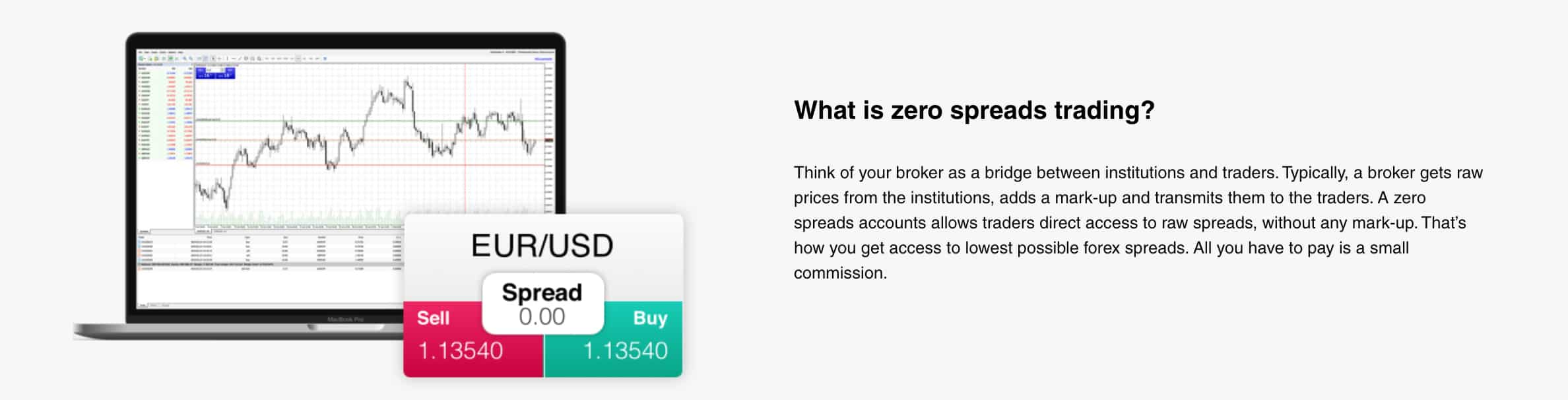

Spreads

Spreads

Leverage

Leverage

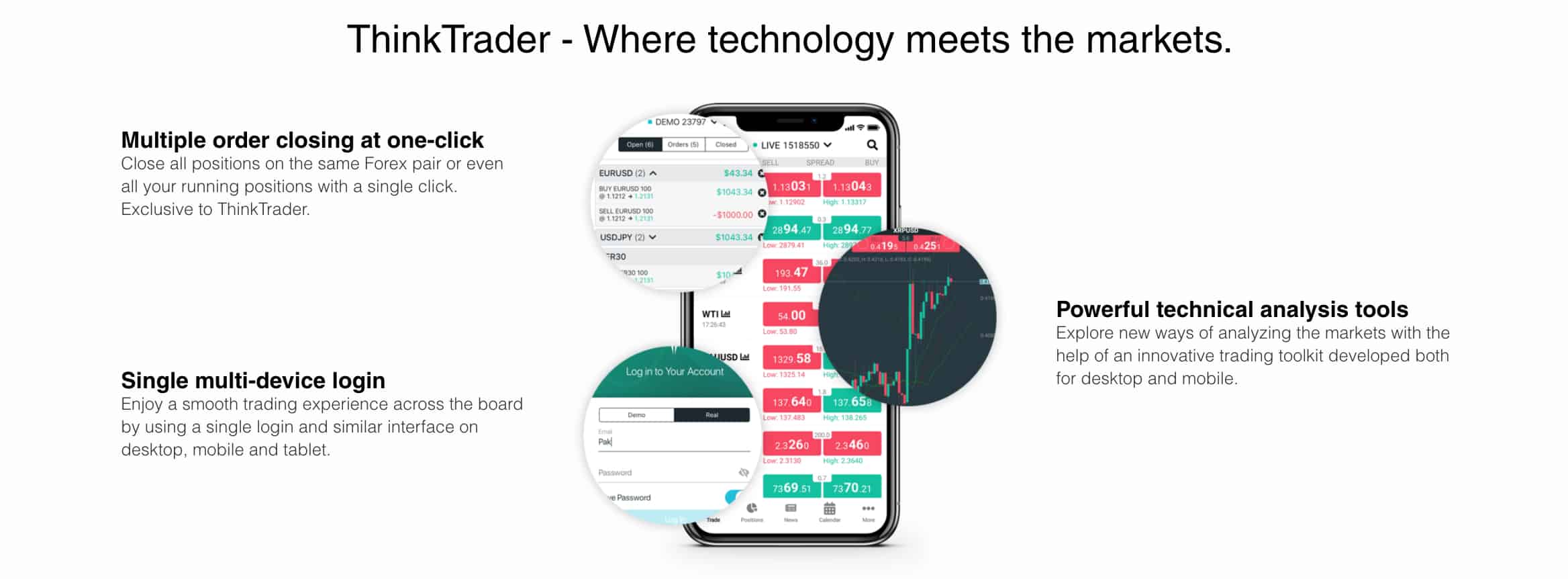

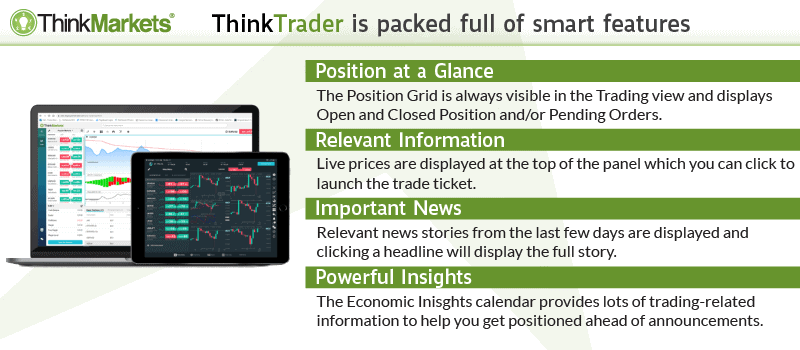

Trading Platforms

Trading Platforms

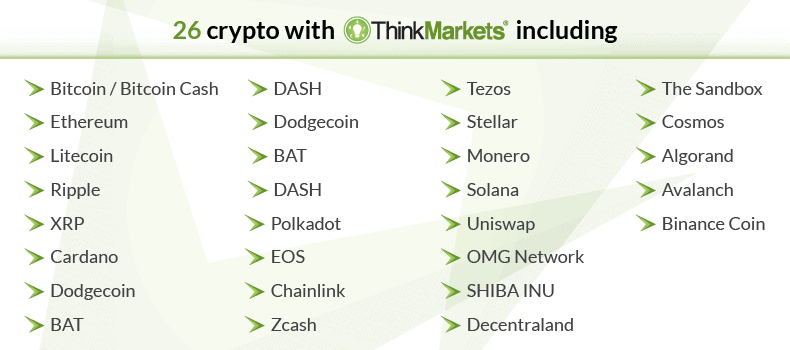

Forex Pairs + CFDs

Forex Pairs + CFDs

Customer Support

Customer Support

Minimum Deposit

Minimum Deposit

Regulation

Regulation

Our ThinkMarkets review (formerly called ThinkForex) found the forex and CFD broker has several impressive features:

Our ThinkMarkets review (formerly called ThinkForex) found the forex and CFD broker has several impressive features:

Ask an Expert

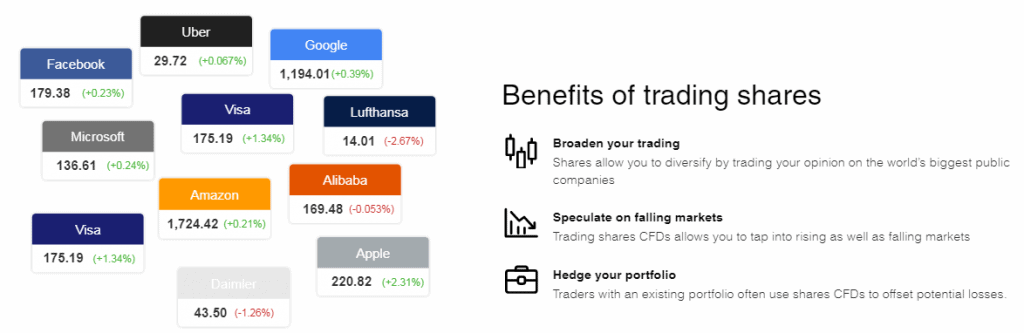

Can I trade normal shares on ThinkMarkets or only CFDs?

Clients with ThinkMarkets Australia and ThinkMarkets America can trade Shares as CFD or proper shares. Clients outside these regions can only purchase CFD shares

Does ThinkMarkets have inactivity fees?

No they don’t