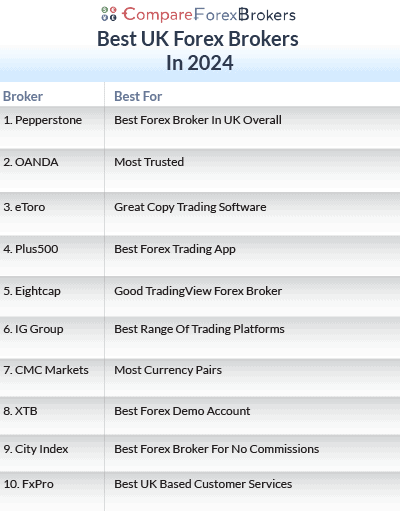

What Are The Best Forex Brokers In The UK?

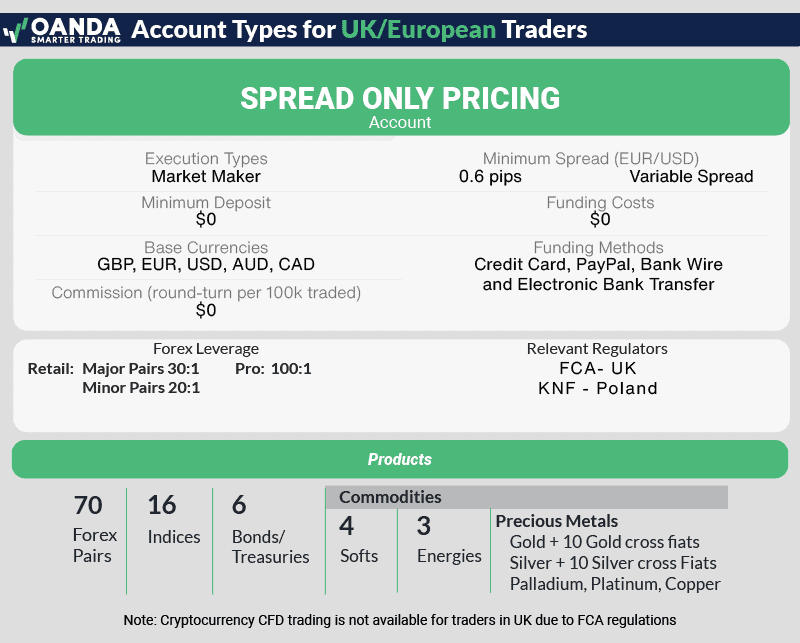

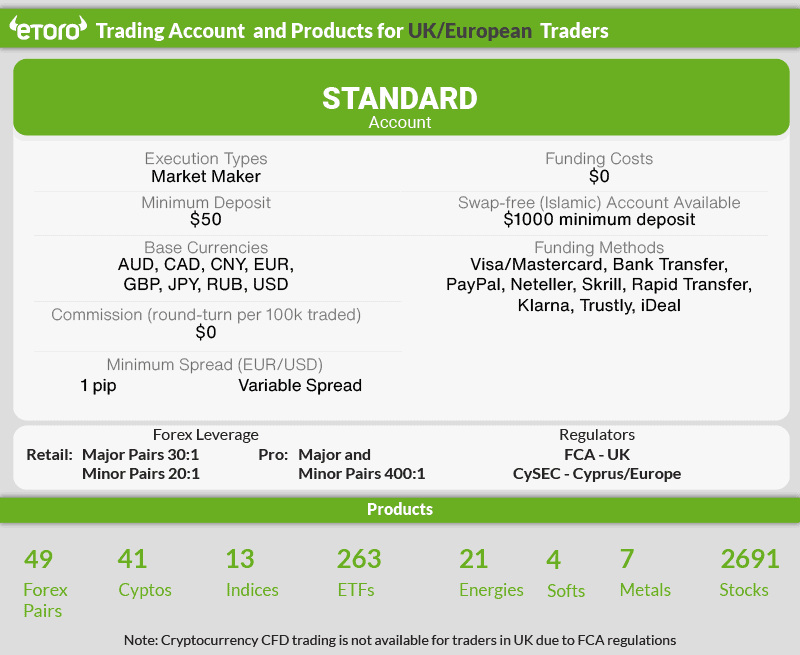

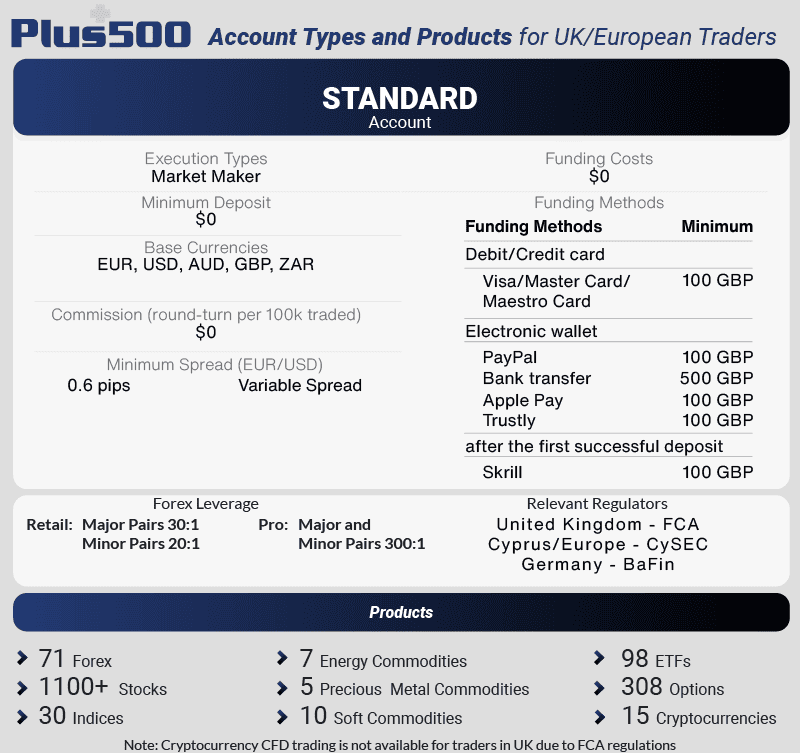

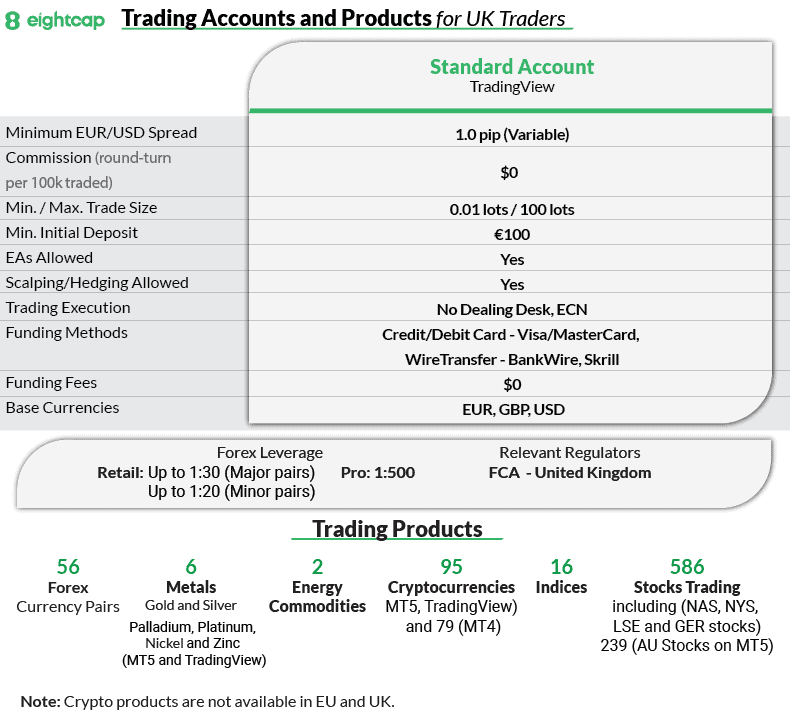

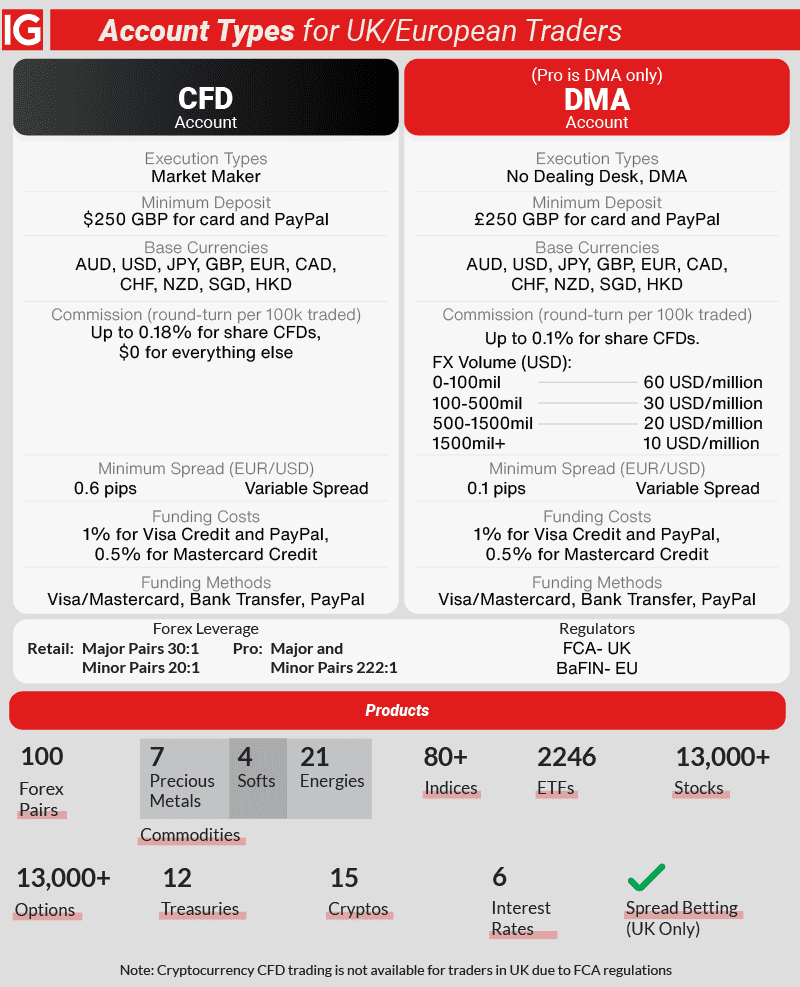

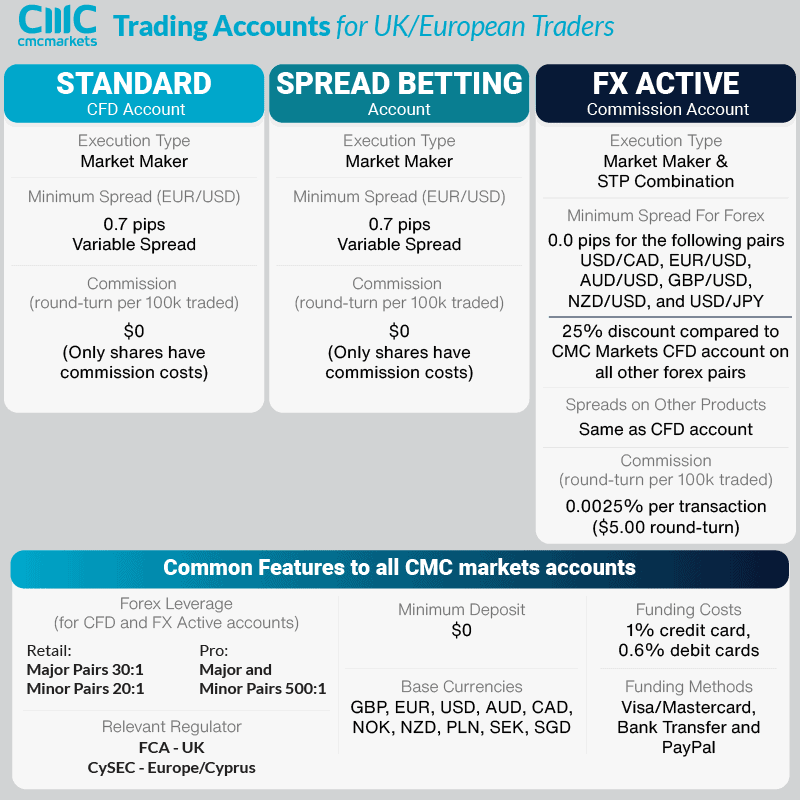

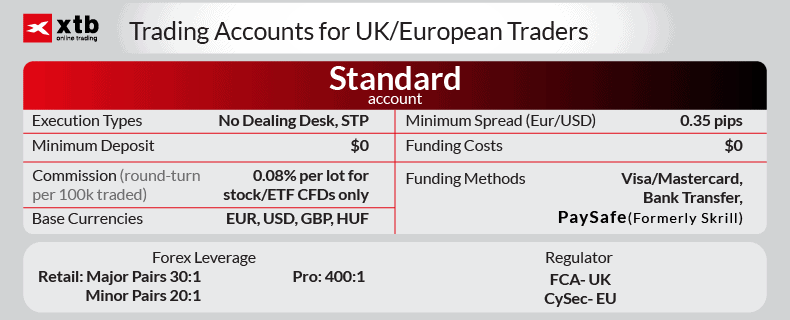

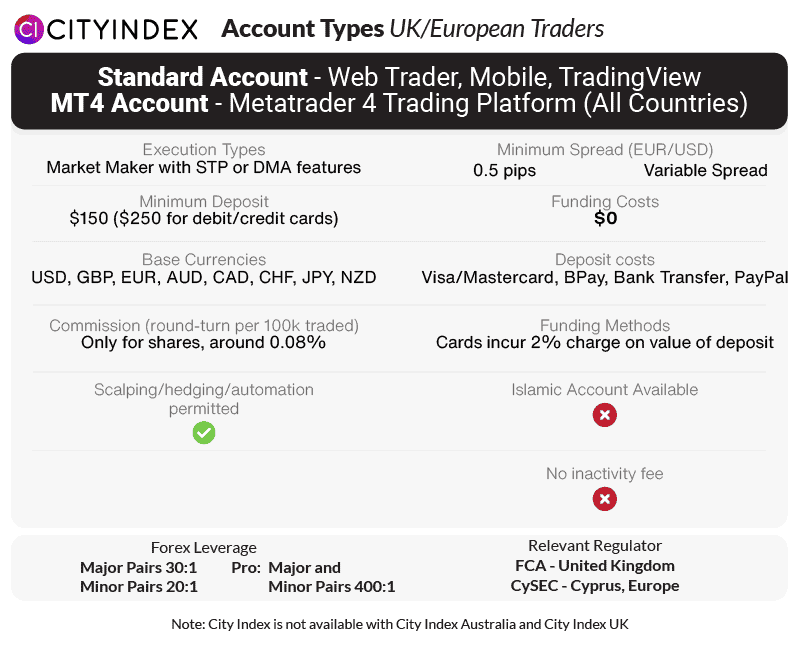

For the 10th year running, our team compared FCA-regulated forex brokers that offer forex trading for residents in the United Kingdom. 65 brokers were compared, shortlisted, and ordered based on spreads and platform features.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert