CMC Markets Review in January 2024

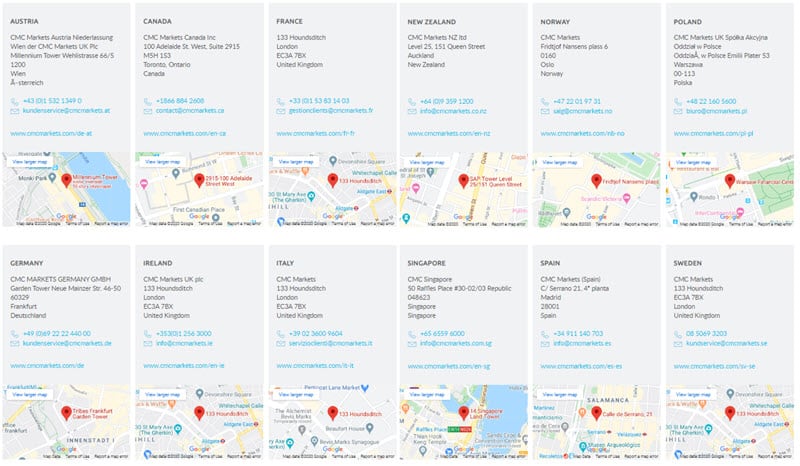

Founded in 1989, CMC Markets is one of the largest forex brokers offering over 9,500 CFDs products across FX, indices, shares to cryptocurrencies with EUR/USD spreads from 0.7 pips and margin rates from 0.20% with cash rebates for high volume forex traders.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

Does CMC Markets really have over 300 Forex Pairs?

Yes but many of these 300 are reversed cross pairs for example AUD/USD. USD/AUD

does CMC allow scalping?

Yes, CMC Markets do allow scalping

hello, what is your spread for XAUUSD

Hi Adeyemi, We are not a broker, to find out CMC Markets spreads please visit their website