GO Markets Review 2024

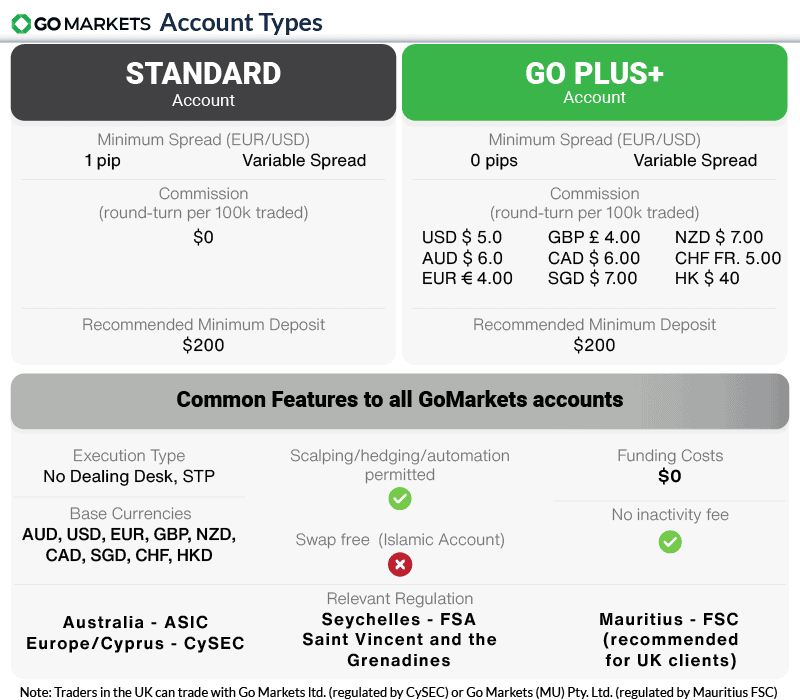

GO Markets introduced the GO Plus+ forex trading account to replace their forex broker pro account which now offers 0.0 pip spreads, the MT4 trading platform, strong customer support and a range of currency pairs backed by ASIC regulation including segregated clients’ funds.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Account Types

Account Types

Spreads

Spreads

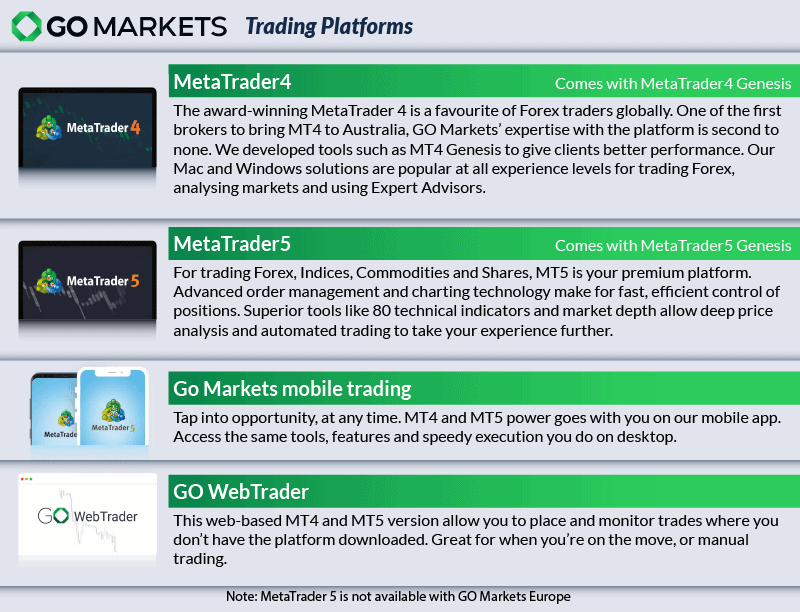

Trading Platforms

Trading Platforms

Customer Support

Customer Support

Minimum Deposit

Minimum Deposit

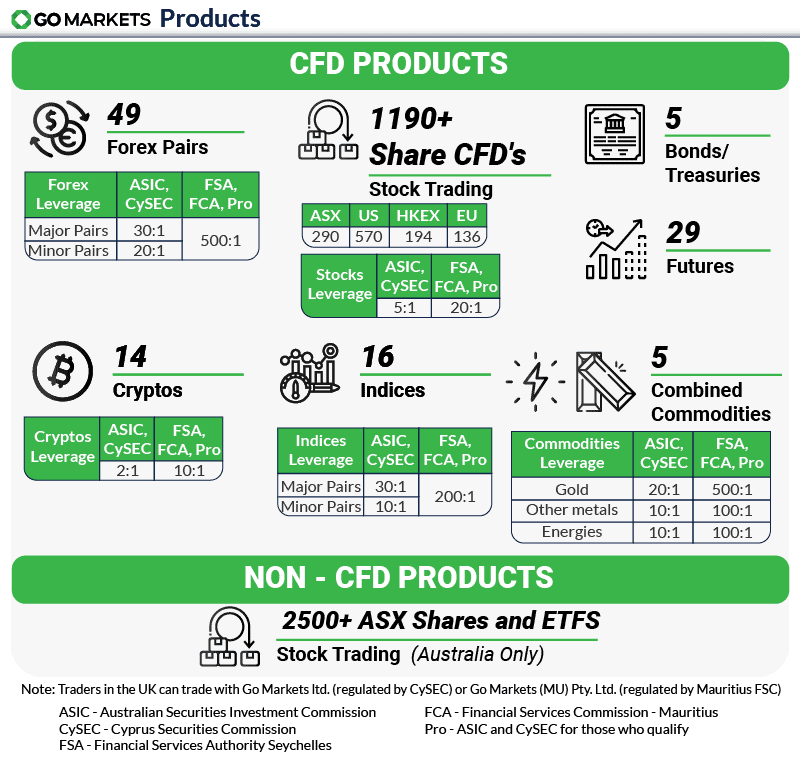

Forex Pairs + CFDs

Forex Pairs + CFDs

Leverage

Leverage

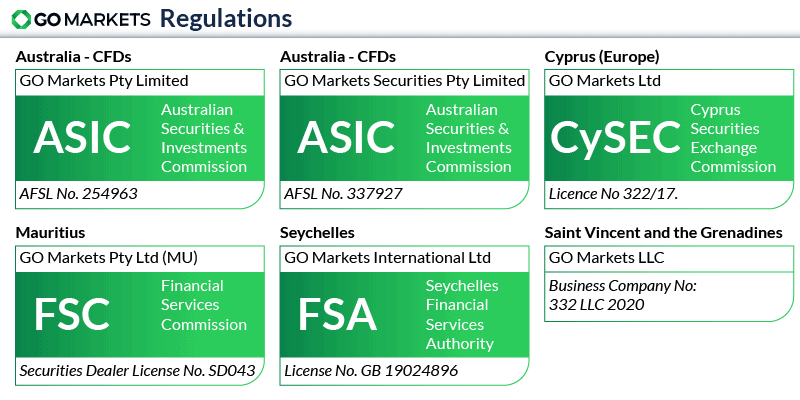

Regulation

Regulation

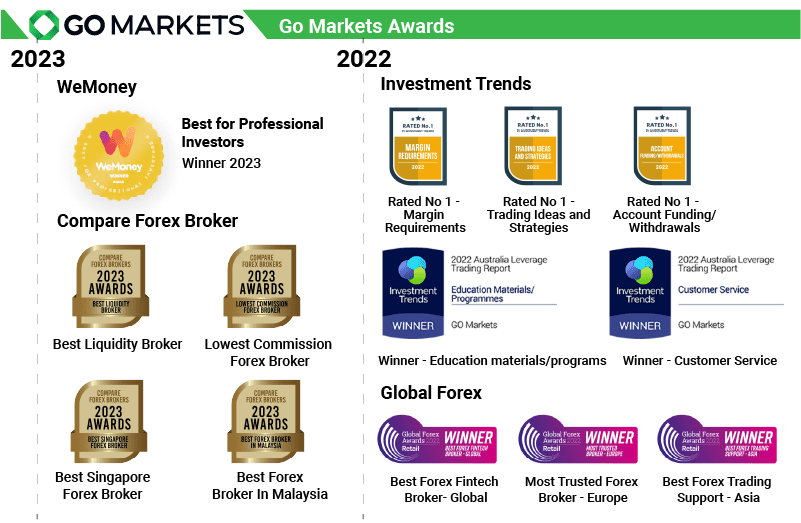

CompareForexBroker has given GO Markets multiple awards including: The broker with the best liquidity, lowest commissions and best broker for Malaysian and Singaporean traders.

CompareForexBroker has given GO Markets multiple awards including: The broker with the best liquidity, lowest commissions and best broker for Malaysian and Singaporean traders.

Customer Support

Customer Support

Ask an Expert

is segregated account available?

Yes, all Go Markets clients will have a segregated account.