IC Markets Spreads And Fees Review

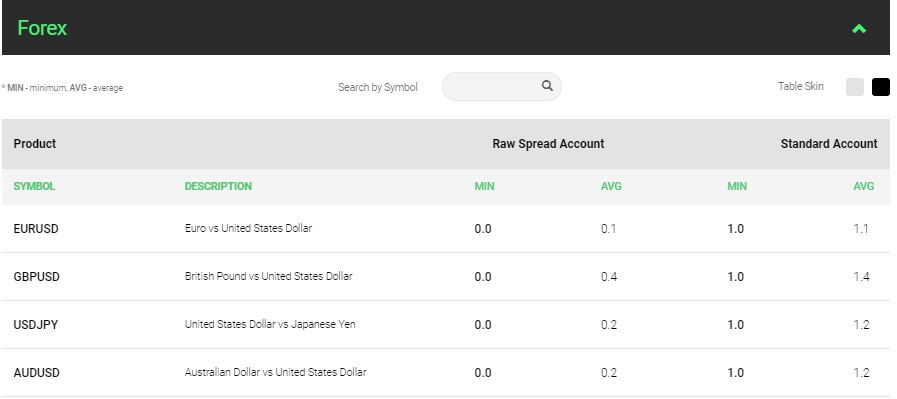

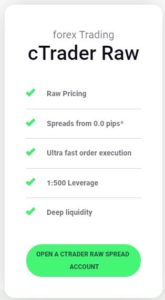

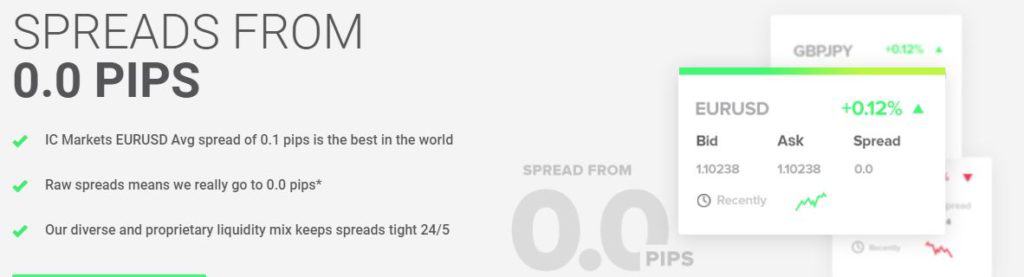

IC Markets offers a Raw Spread forex trading accounts with ECN pricing. 65 currency pairs are available with spreads starting from 0.0 pips for the EUR/USD fx pair. Trading platforms include MetaTrader 4, MT5 and cTrader and the choice of 232 trading instruments.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert