What Are the Best Forex Brokers In Malaysia?

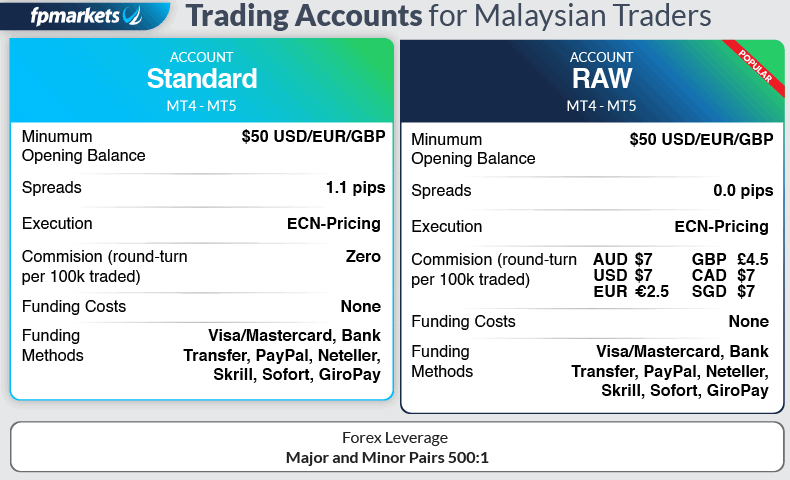

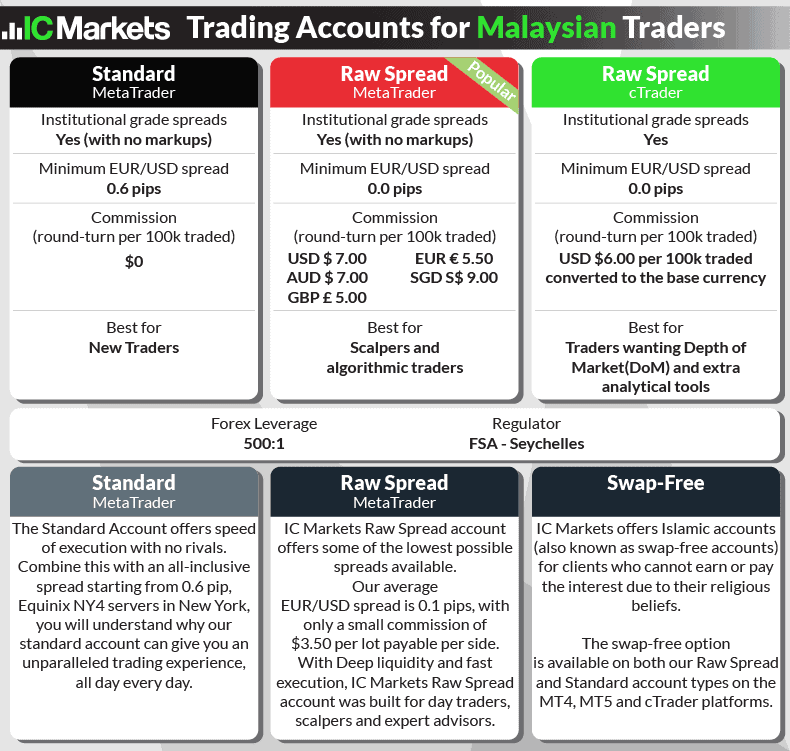

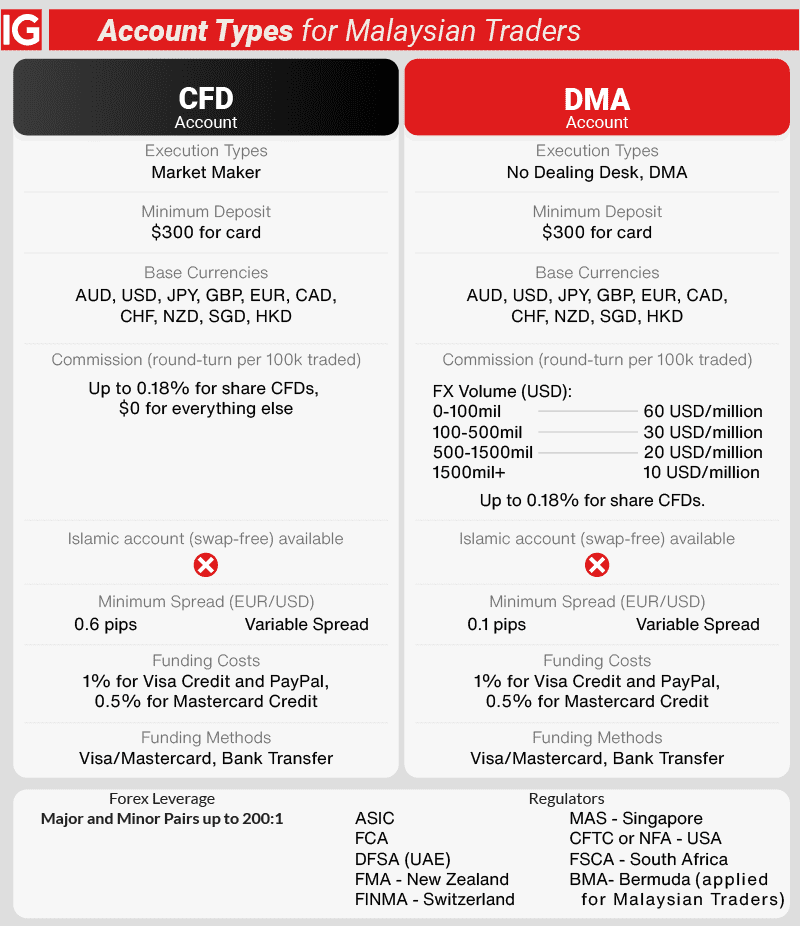

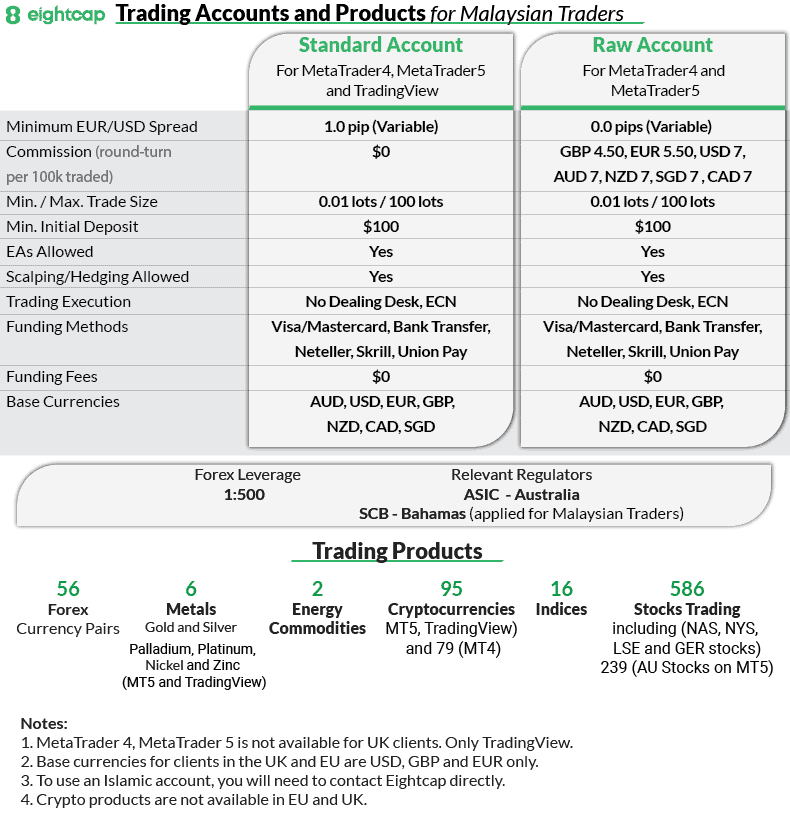

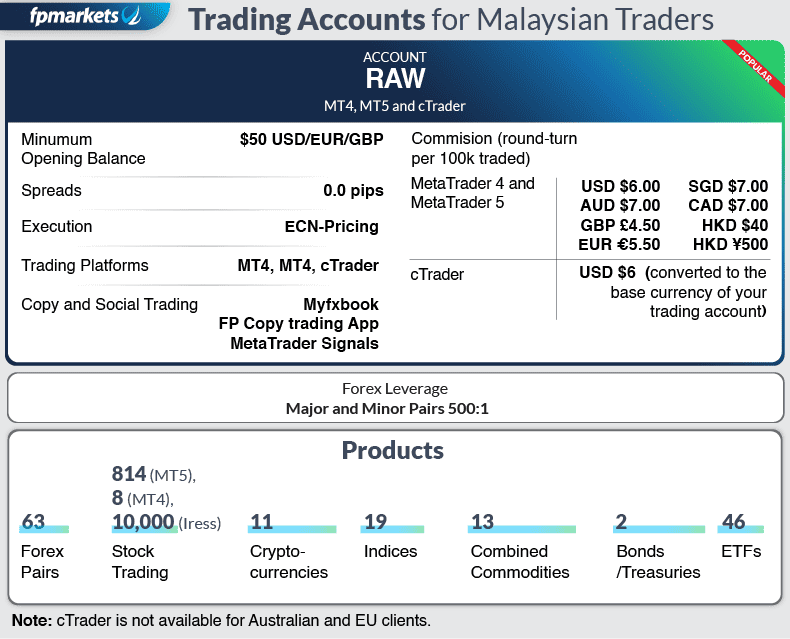

The Securities Commission of Malaysia (SCM) has no licenced forex broker, so Malaysian residents will have to trade forex tier-1 brokers regulated by ASIC or MAS. Muslim Malaysian Traders should choose a swap-free Islamic account.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

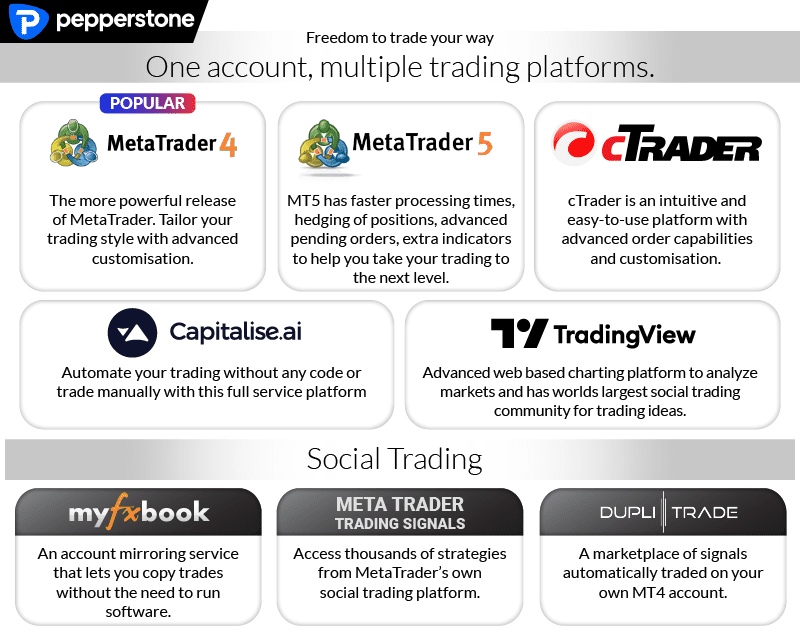

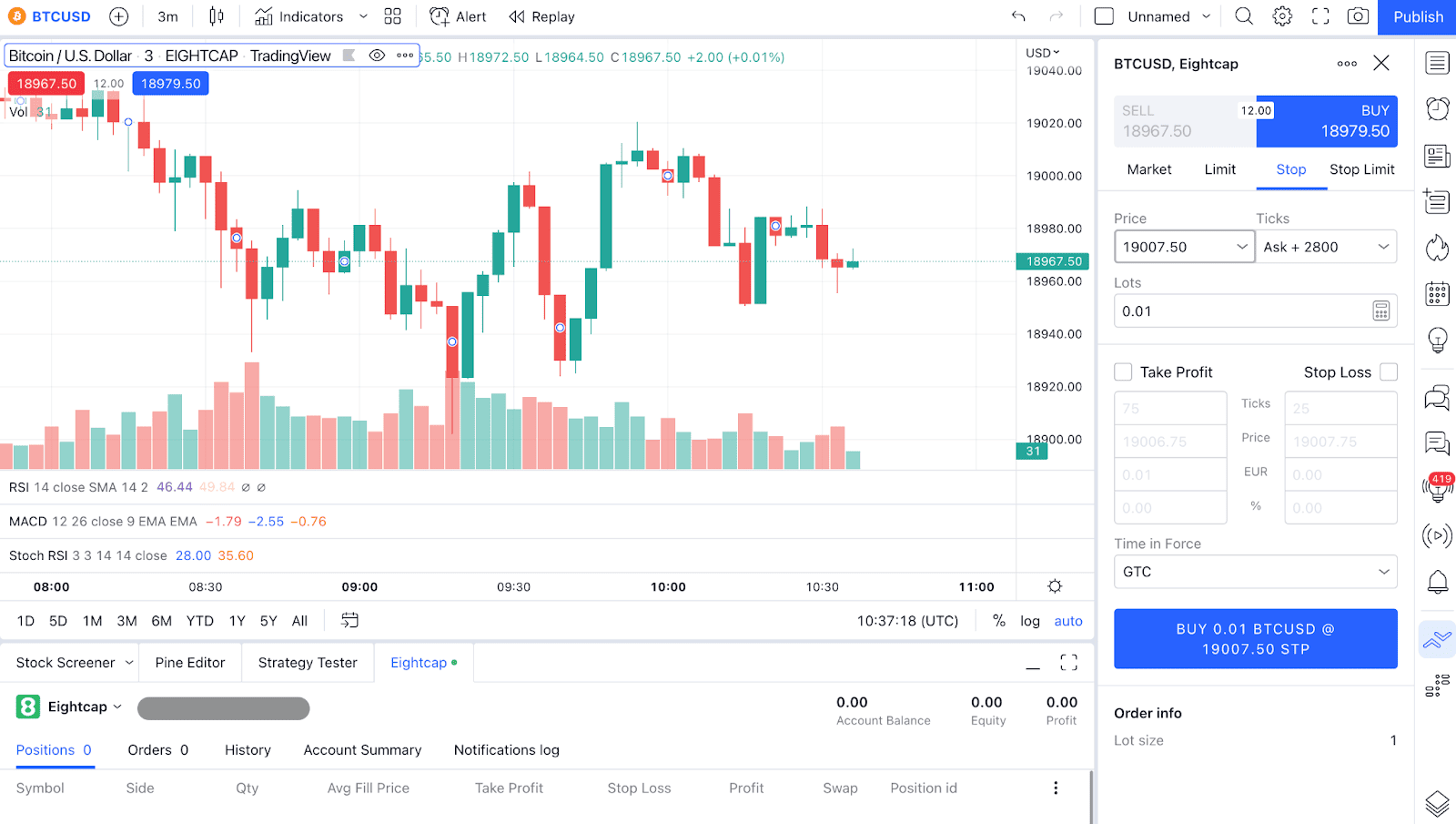

automated trade execution and risk management tools, traders can more easily profit from the Forex market while keeping their risk levels in check. CMC Markets’ global market offering is available to trade via the broker’s proprietary platform, Next Generation or MetaTrader 4.

automated trade execution and risk management tools, traders can more easily profit from the Forex market while keeping their risk levels in check. CMC Markets’ global market offering is available to trade via the broker’s proprietary platform, Next Generation or MetaTrader 4.

Ask an Expert