What Are The Best MT4 Brokers?

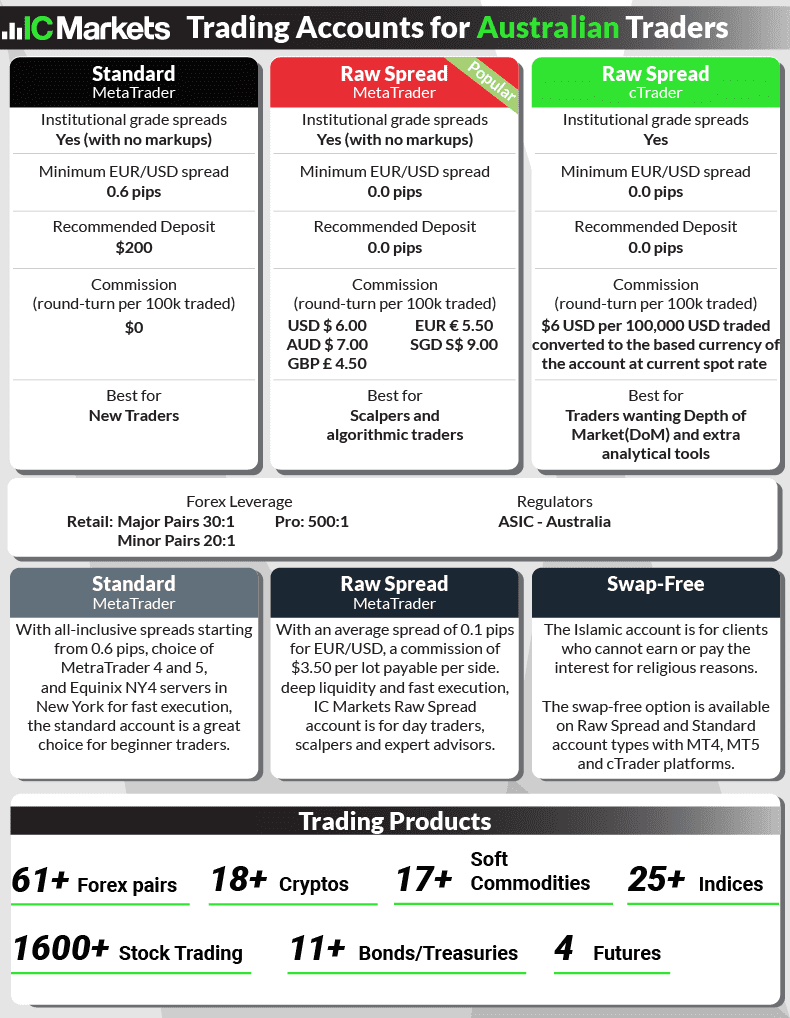

To help choose an MT4 forex broker, a list of the best MetaTrader 4 brokers in April 2024 was created based on spreads, execution speed and forex trading platform features. The only MT4 brokers considered were regulated and had a strong global reputation.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

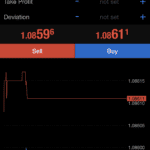

iPhone

iPhone

To activate a tick chart in the MT4 trading platform, you need to:

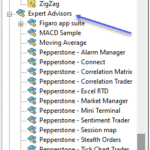

To activate a tick chart in the MT4 trading platform, you need to: The Candle Clock indicator helps identify the time before the last candle is closed. As the timeframe gets closer to closing, the indicator acts like a countdown clock. As an example, when trading from a one-minute chart, the indicator shows the seconds and minutes left.

The Candle Clock indicator helps identify the time before the last candle is closed. As the timeframe gets closer to closing, the indicator acts like a countdown clock. As an example, when trading from a one-minute chart, the indicator shows the seconds and minutes left.

Ask an Expert

Is MetaTrader 4 better than MetaTrader 5?

Depends, MetaTrader 4 (MT4) is considered by many to be the gold standard trading platform for forex trading. MetaTrader 4 has all the features you need for the successful trading of forex. However, MetaTrader 5 (MT5) is an upgrade on MT4. It allows you to trade more CFD instruments, has more technical analysis tools and has more memory and runs faster making it a better option for backtesting. However there are still good reasons to choose MT4 over MT5, reasons include:

1. MT4 was designed specifically for forex trading. Best for trading instruments that are decentralised (i.e. don’t have a central exchange)

2. More brokers offer MT4, so more choice of fore brokers and easier to change to new forex brokers that also offer MT4

3. MT4 is 32 bit, MT5 is 64 bit meaning MT4 uses less computing resources if you don’t have the most powerful computer

4. MT4 has Financial Information eXchange (FIX) API integration for real-time information related to financial instruments

5. While MT4 has fewer technical analysis tools than MT5, this can make it preferable to new traders who may get overwhelmed with too much information

6. MT4 is easier to install and set up than MT5. This means you can get started trading faster

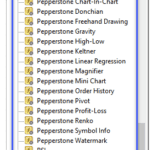

7. MT4 has a larger marketplace to source extra tools such as expert advisors

8. MT4 has a larger trading community meaning more resources are available when extra information is needed

Why do traders prefer MT4?

There are multiple reasons – More brokers offer it (and with no) than any other platform as result it is more accessible to retail traders which created more awareness of the platform. It has all the essential features one needs to trade and is also very flexible. For example you can customise the interface or create your own indicators. Lastly, there is very little it can’t do – you can automate your trading with Expert Advisors or copy trade using Signals. It main weaknesses are that its not built for exchange traded instruments like Shares and does not have a Depth of Market indicator.

Why do people still use MetaTrader4?

MetaTrader 4 maintains it popularity as it is a simpler trading platform to use, many new traders it easier to navigate than MT5. MT4 is also more familiar, that is more traders already use it and don’t wish to learn a new trading platform and there is more general awareness of the trading platform. Other reasons MT4 is more popular than MT5 is more brokers offer it, there is a larger trading community and traders don’t need the extra features MT5 can offer.

How much does it cost to get MT4 license?

Metatrader 4 (MT4) is free for use with brokers that offer this trading platform. There is no need to pay for an MT4 licence.