Axi Review

Australian forex broker Axi offers ECN style tight spreads for its Pro Account. Through the MT4 platform, you can access 140+ currency pairs for forex trading, $0 minimum deposit, fast execution, award-winning customer support and other CFD products including cryptocurrencies like Bitcoin.

See our Axi Standard vs Pro Account review and our Axi review below:

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Account Types

Account Types

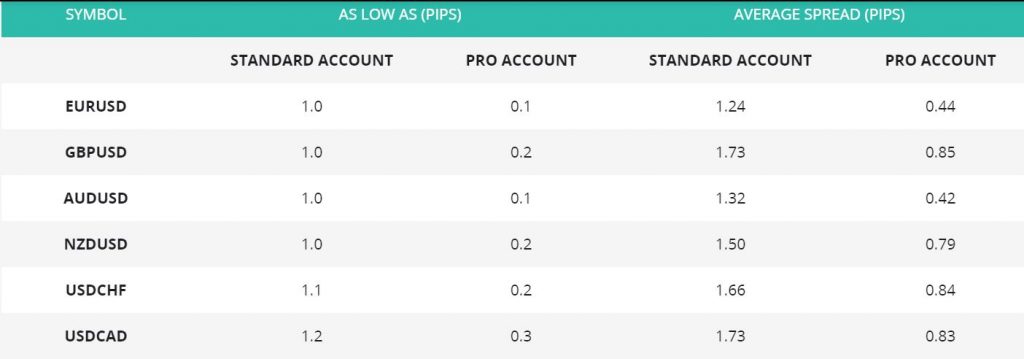

Spreads

Spreads

Trading Platforms

Trading Platforms

Forex Pairs + CFDs

Forex Pairs + CFDs

Minimum Deposit

Minimum Deposit

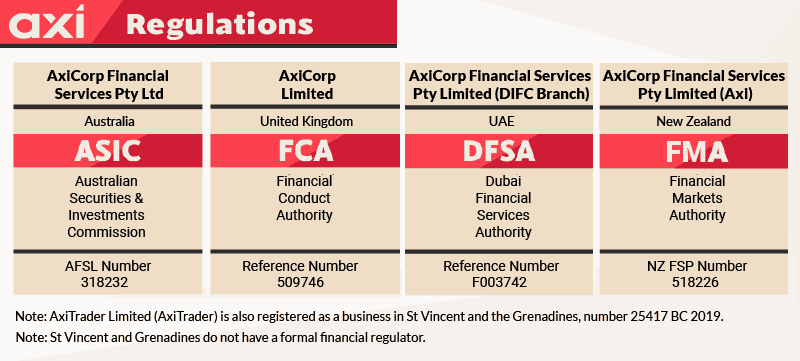

Regulation

Regulation

Customer Support

Customer Support

1) MT4 Standard Account

1) MT4 Standard Account

Ask an Expert

Is MT4 the only platform offered by Axi?

Yes however you can also use MyFxBook and ZuluTrade for copy or social trading