Pepperstone Review In April 2024

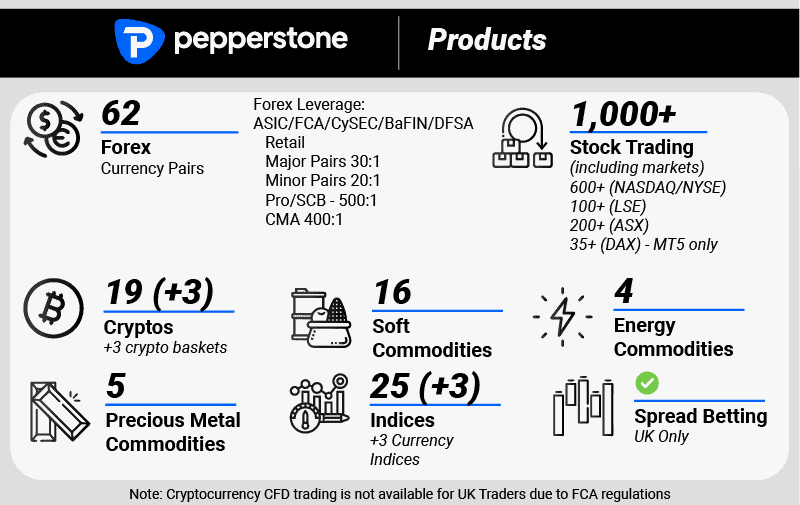

Pepperstone is the best-rated forex broker based on trading experience, low fee structure, and customer support levels. The popular Pepperstone razor account offers minimum spreads starting from 0 pips for the EUR/USD currency pair plus a $3.50 commission per lot charged.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

Is Pepperstone the best broker for MetaTrader?

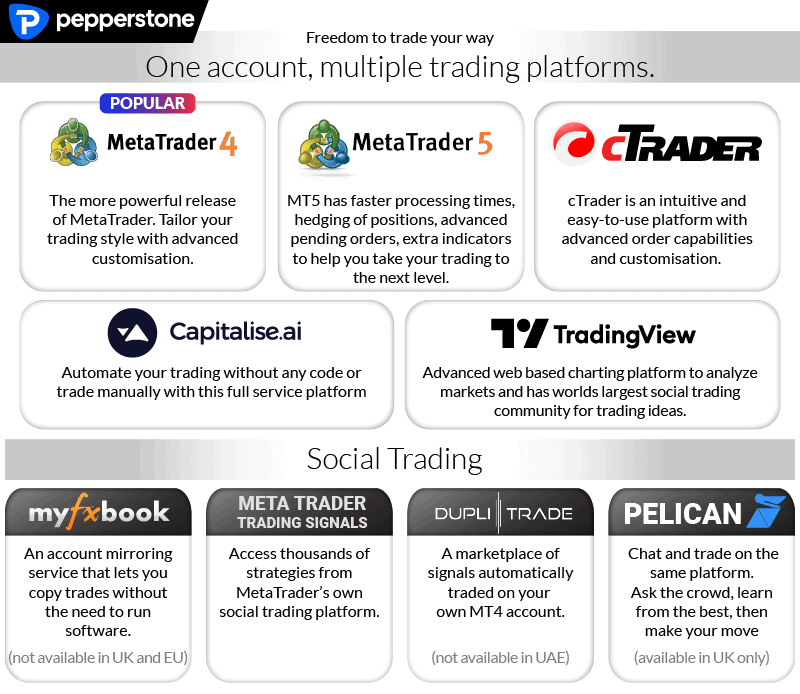

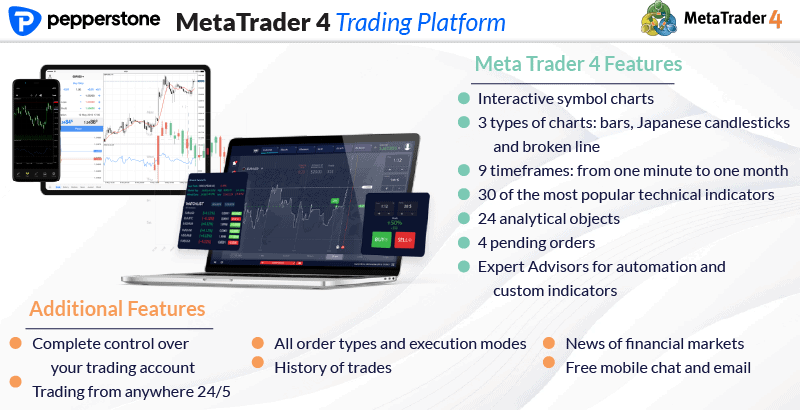

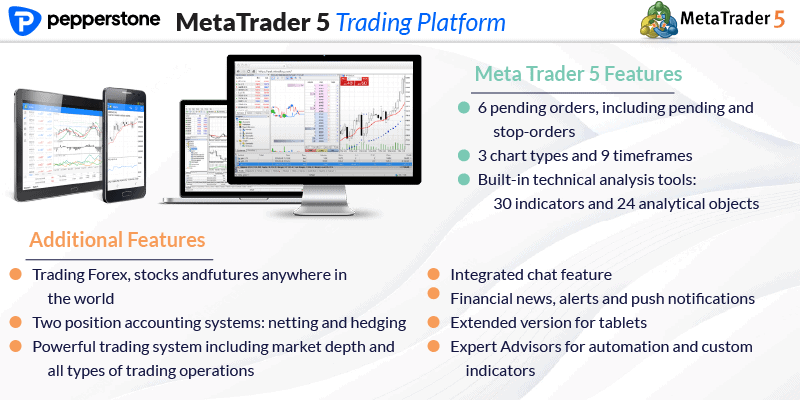

Pepperstone is one of many brokers that offer MetaTrader 4 and one of the few that offers MetaTrader 5.

Pepperstone is a great choice for MetaTrader since they allow expert advisors (EAs) and allow you to integrate 3rd party apps such as MyFxBook for copy trading with the platform

As a bonus Pepperstone also include Smart Trader tools for 28 additional apps to give you even more trading features and their own exclusive Figaro Advanced Traders tools for yet more trading features.

I’m looking to open a Pepperstone account but I’m not sure if the standard or Razor account is better. I’m based in the UK. What account is more popular in my region?

We checked this with Pepperstone, in the UK the standard account is more popular, while in Australia the Razor account is more popular. Which account is better, depends on your needs, many traders don’t want to deal with the added complexity commissions add when trading so prefer the standard account but if you want to he tightest speads, then the Razor account is the way to go

Can I use Pepperstone’s Islamic account if I am based in the UK?

Pepperstone doesn’t make their swap-free account available as part of their 2022 Pepperstone Limited subsidiary which operates in the UK. So officially a swap-free account is not available for traders in the UK. You can always try reaching out and requesting directly with Pepperstone support team and see what happens

I am from India which broker should I choose

I would suggest you choose a broker from out best for beginner page. Check the navigation for the location.

That is up to you but we don’t cover Forex brokers in India so cannot really advise

What is the minimum leverage for pepperstone?

There is no minimum leverage requirement, on minimum margin requirement. The maximum leverage for Forex in Australia, UAE, The UK and Europe is 1:30 and 1:400 in Africa and 1:200 in other regions.

Is Pepperstone a good broker for beginners?

Pepperstone can be a good option for beginners as they have $0 minimum deposit, free demo accounts with all trading platforms and an award winning customer service team to help you get started. The broker also has good education tools to help your learn to trade. While their Razor account is suitable for all traders, their standard account is popular with beginners since the commission is built into the spread.