AXI vs IG Group: Which One Is Best?

Our comprehensive comparison of Axi vs IG Group dissects key areas like trading costs, Forex trading platforms, and regulations to help you choose the right Forex broker.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

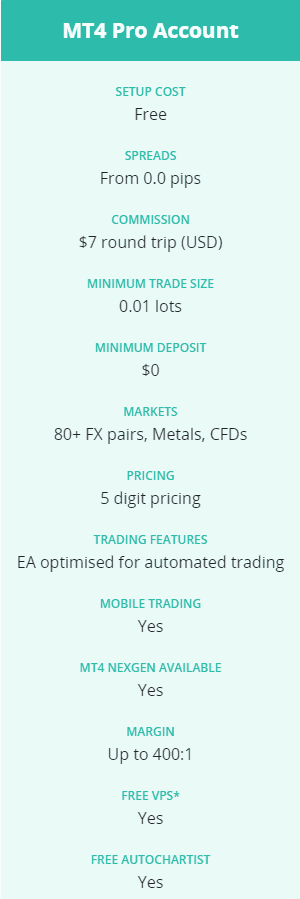

The Axi Pro account has several key features to note:

The Axi Pro account has several key features to note:

Ask an Expert

Which is better to copy trade on? Axi or on IG?

IG only has copy trading via MT4 and you are limited to Standard spread only. Axi might be a better choice, you can use MT4 Signals or Axi Copy Trading App which connects you to the MetaTrader Signals network and you can choose between a standard or a RAW spread account.

What is the highest leverage on IG market?

For retail traders it can be 1:30 in the UK, Australia, Europe, New Zealand and UAE. This is the maximum allowed by the regulator. For other regions and for professional traders it is 1:200.