Best CFD Trading Platforms

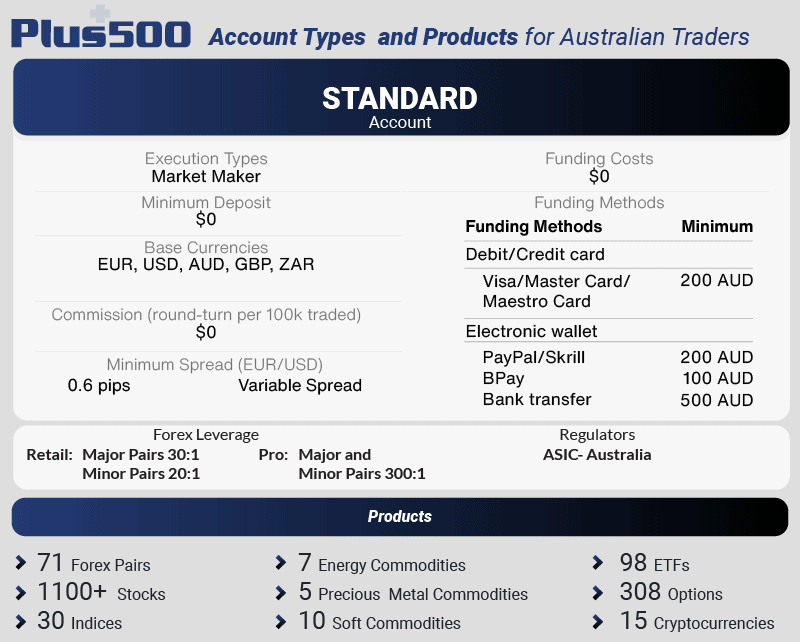

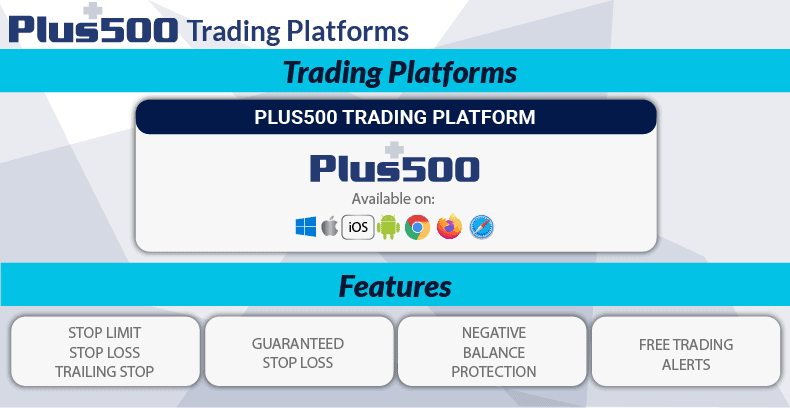

Australian traders looking for the best CFD broker should compare spreads, range of markets and the CFD trading platform offered by the provider. Our CFD trading platform Australia comparison in April 2024 sorted these criteria to find the best CFD broker.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

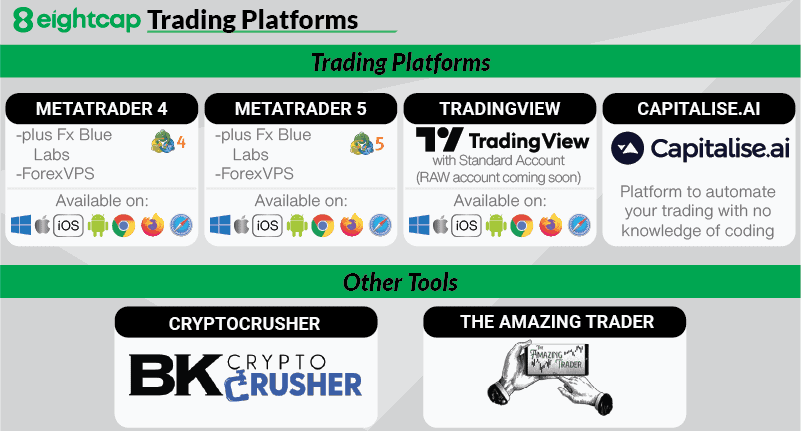

This article forgot to include Capital.com, which has a much larger range of CFD instruments than most listed here. Also Pepperstone and IC Markets (correct me if I’m wrong) use the cTrader backend? It would be good to include just how many CFD codes can actually be traded per platform in stocks, currencies, commodities, crypto, etc.

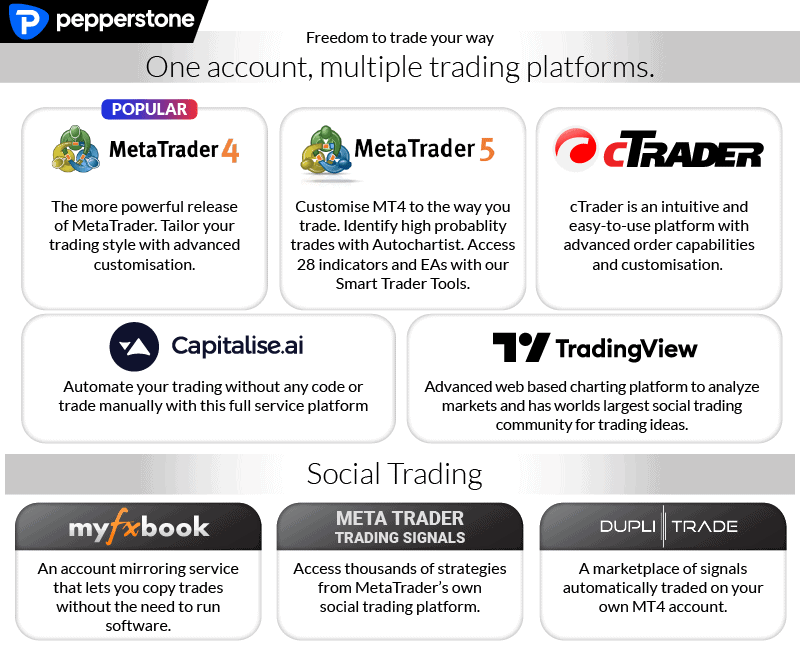

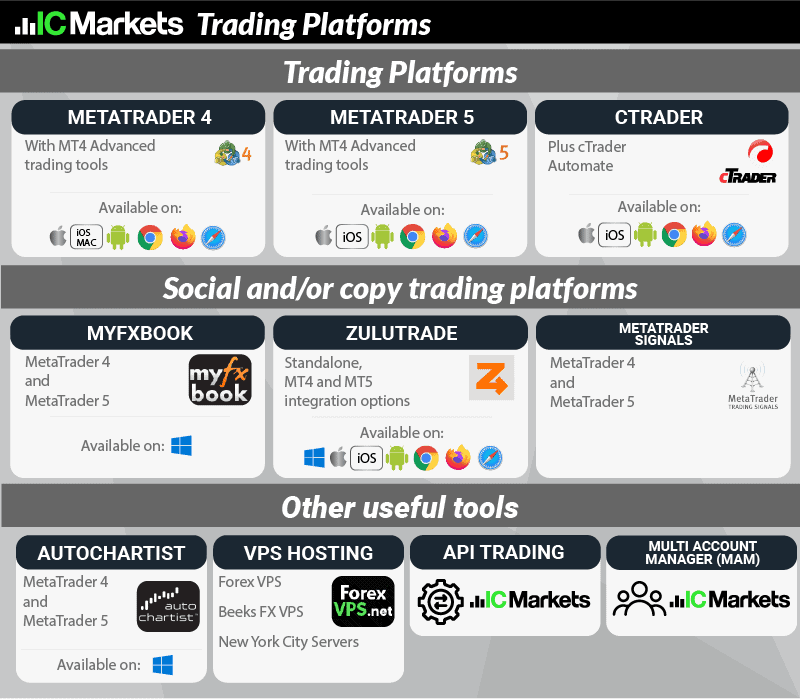

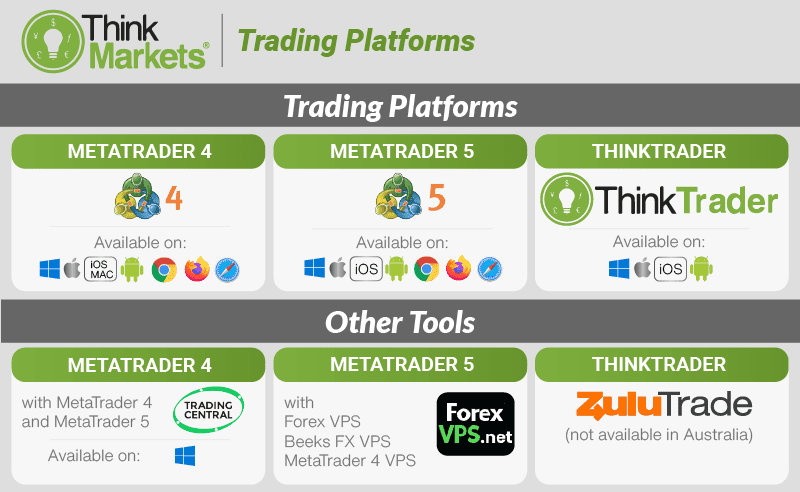

Hi J.S. There are many quality (and some not so good) brokers one can choose from. We recommend the brokers we feel worthy of making this list. In time, its possible we will add Capital.com. Pepperstone and IC Markets use MetaTrader backends for MT4 and MT5. Pepperstone also uses MetaTrader backend for Capitalise.ai. Both brokers use cTrader backend for cTrader while Pepperstone also use cTrader backend for TrdingView

Is forex easy money?

No, 60% to 80% of retail traders lose money. Only trade what you can afford to lose.

Is forex trading legal in the UK?

Yes it is. You will need to declare any capital gains taxes as income but you can also claim any losses too.

Is it a good idea to become a full time trader or is it a side hustle job?

That depends on your skills and ability to make money when forex trading and how much income you have saved up and can afford to lose. Everyone is different.

What is more beginner friendly MT4 or 5?

Depends what you call beginner friendly…are you looking for platofrm with risk management tools? then EasyMarkets is a good option, IG, OANDA, City Index custom platform include a guaranteed stop loos. Or maybe you need a broker with good education tools?

What is a pip exactly? And is it the same as spread ?

A pip is the smallest amount a currency can move. When you see the AUD/USD quoted as 0.6410, a pip is a movement of 0.0001 up or down.

The spread is simply the difference between the bid (what you can sell a currency at) and the ask (what you can buy a currency at) that you see on your trading platform.

Is forex better than stocks?

THat really depends on your personal preference, knowledge and skills as a trader