City Index Review

Forex broker City Index is owned by the StoneX Group Inc. With MT4 trading platform and no commission trading, this City Index review looks at what they offer the markets in Australia, The UK, and Singapore.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

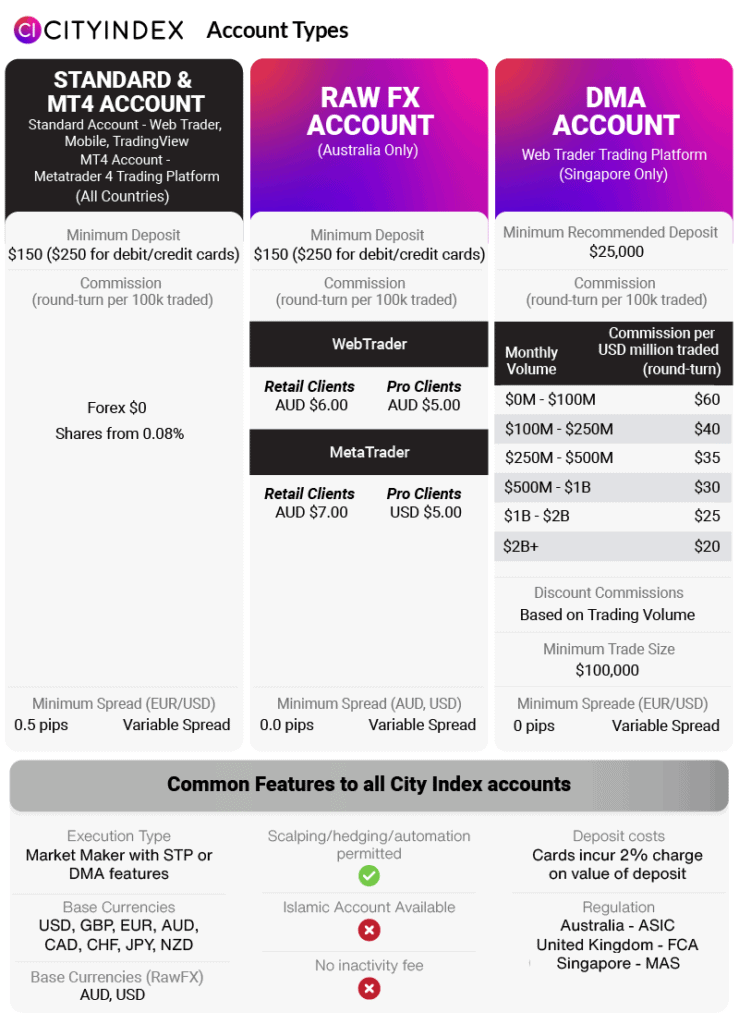

Account Types

Account Types

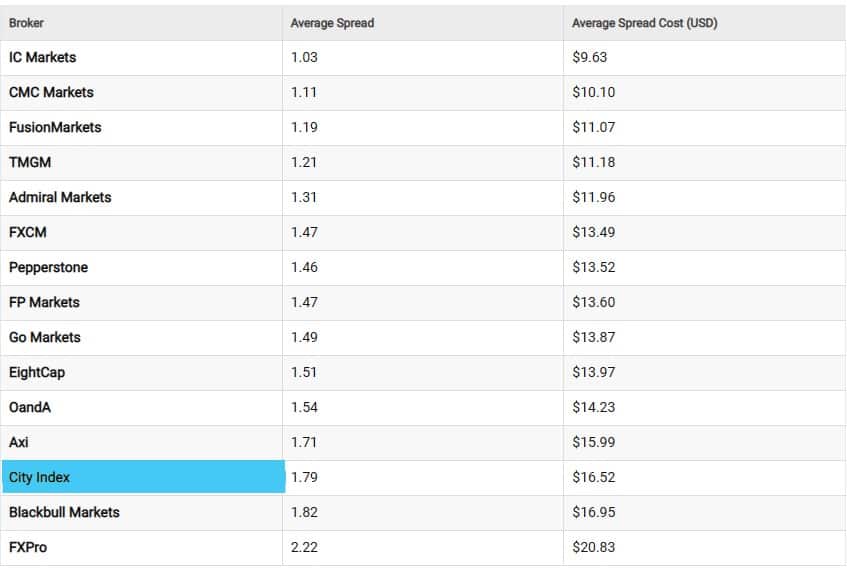

Spreads

Spreads

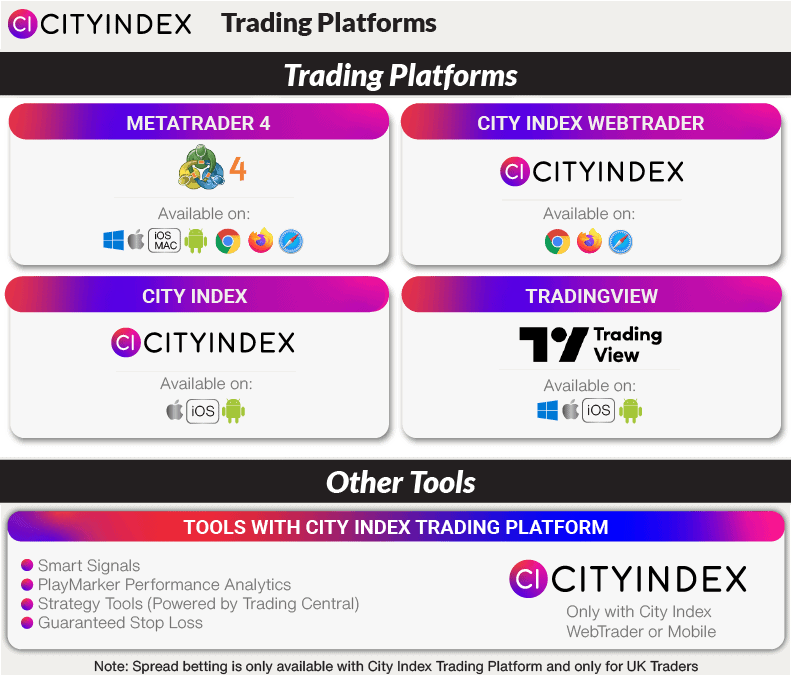

Trading Platforms

Trading Platforms

Leverage

Leverage

Minimum Deposit

Minimum Deposit

Customer Support

Customer Support

Regulation

Regulation

Desktop

Desktop

Ask an Expert

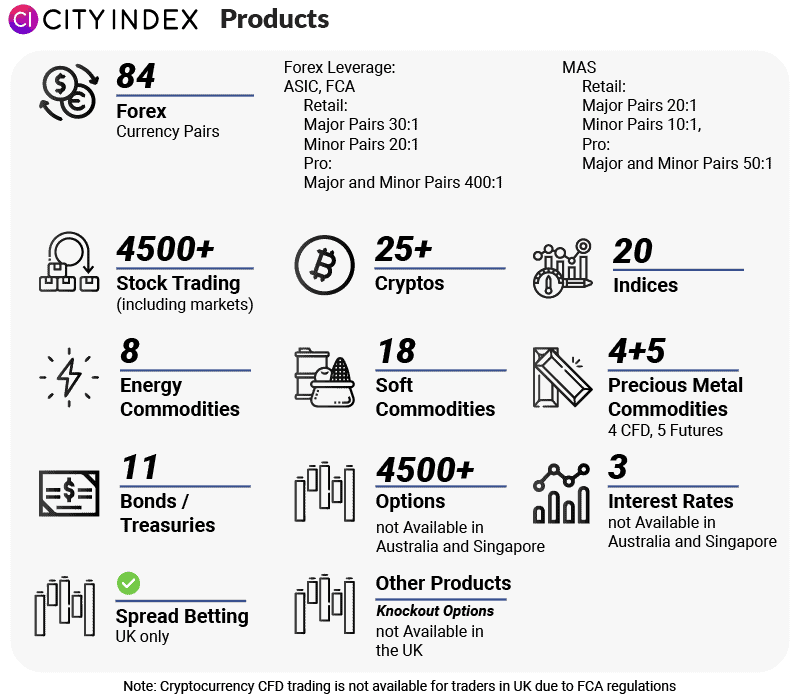

Can you trade options with City Index?

Yes, you can trade options with City Index. There are over 20 options markets to choose from and you will need to use the City Index desktop or Android, iOS mobile app. Options are spread-only products meaning there are no commissions.