easyMarkets Review

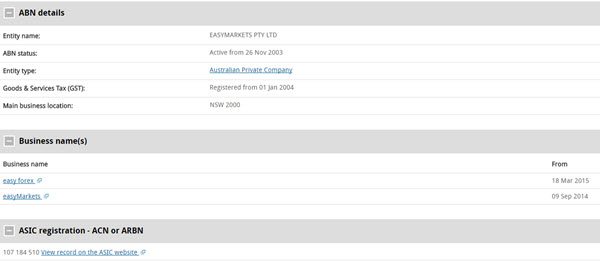

Originally EasyForex, easyMarkets is an ASIC and CySEC-regulated forex broker with 200+ CFDs instruments and 64 currency pairs, exclusive risk management tools, strong customer support and the choice of the MT4, MT5, TradingView and easyMarkets forex trading platform.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

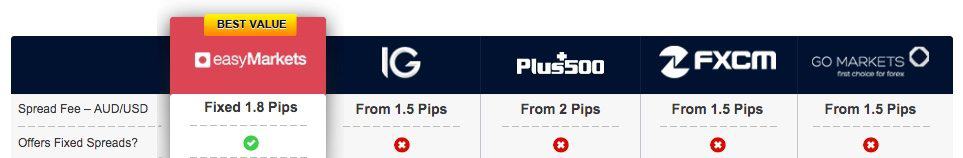

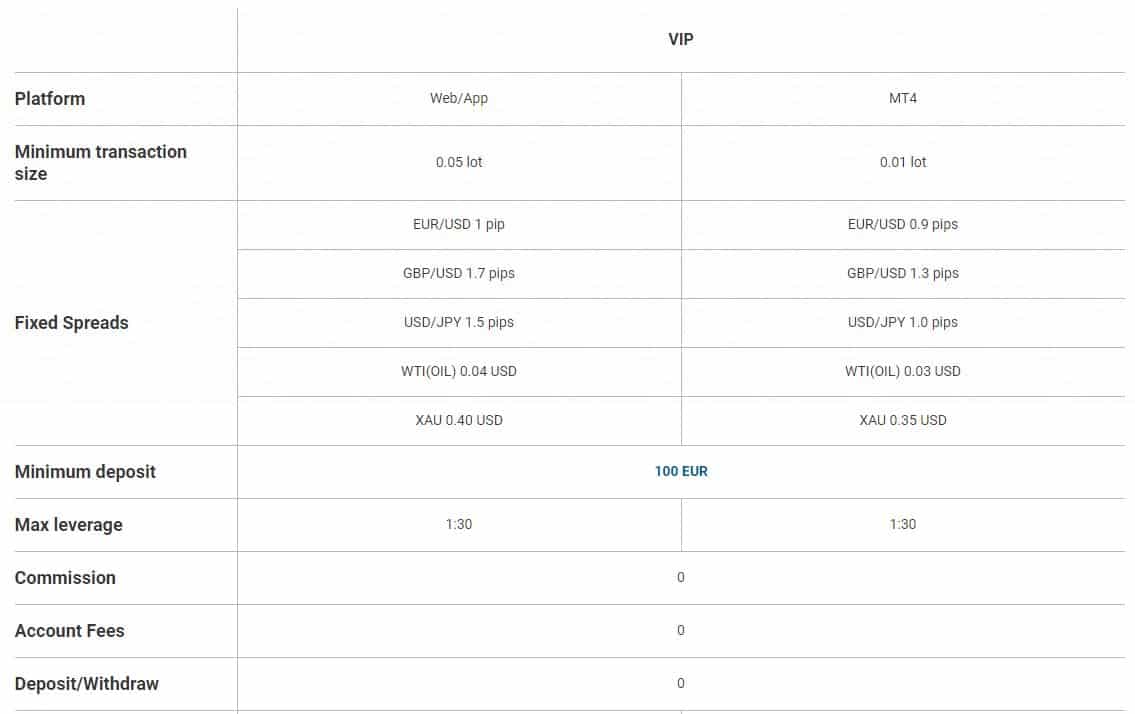

Spreads

Spreads

Leverage

Leverage

Trading Platforms

Trading Platforms

Minimum Deposit

Minimum Deposit

Customer Support

Customer Support

As the table above highlighted, two of the most popular contact methods are phone and live chat. Live chat is not offered by all the forex brokers and is ideal for short questions relating to traders.

As the table above highlighted, two of the most popular contact methods are phone and live chat. Live chat is not offered by all the forex brokers and is ideal for short questions relating to traders.

Deposits And Withdrawals

Deposits And Withdrawals

Ask an Expert

I use eWallets more than online banking, when is the best time to withdraw from EasyMarkets?

It doesn’t matter when you withdrawal except best to do it during business hours not weekends.

Does easyMarkets allow hedging?

Yes, as long as it in good faith. That is, as long as you are not trying to ‘game’ the system.