easyMarkets vs IG Group: Which One Is Best?

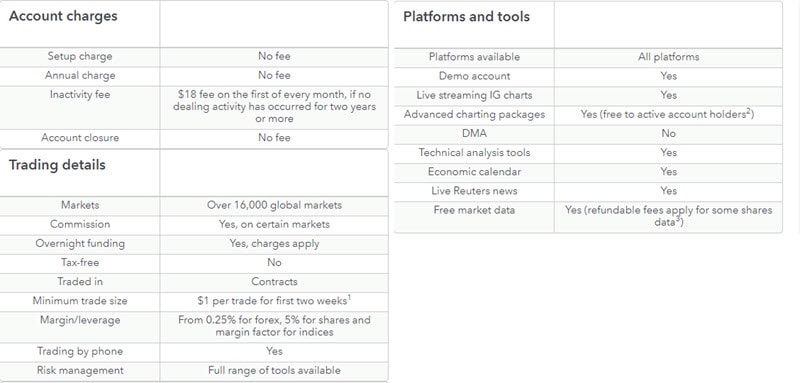

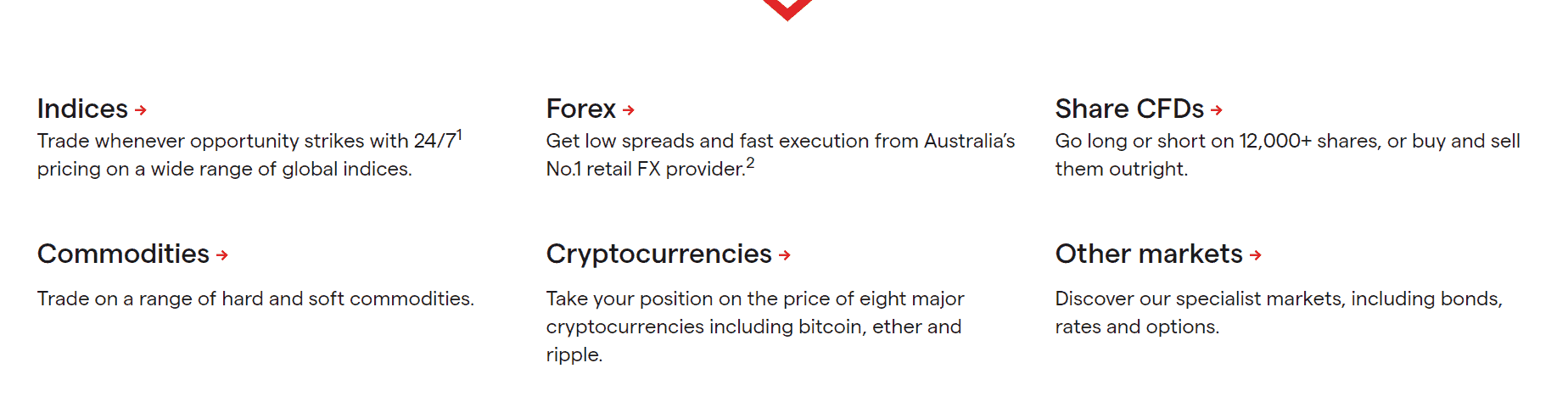

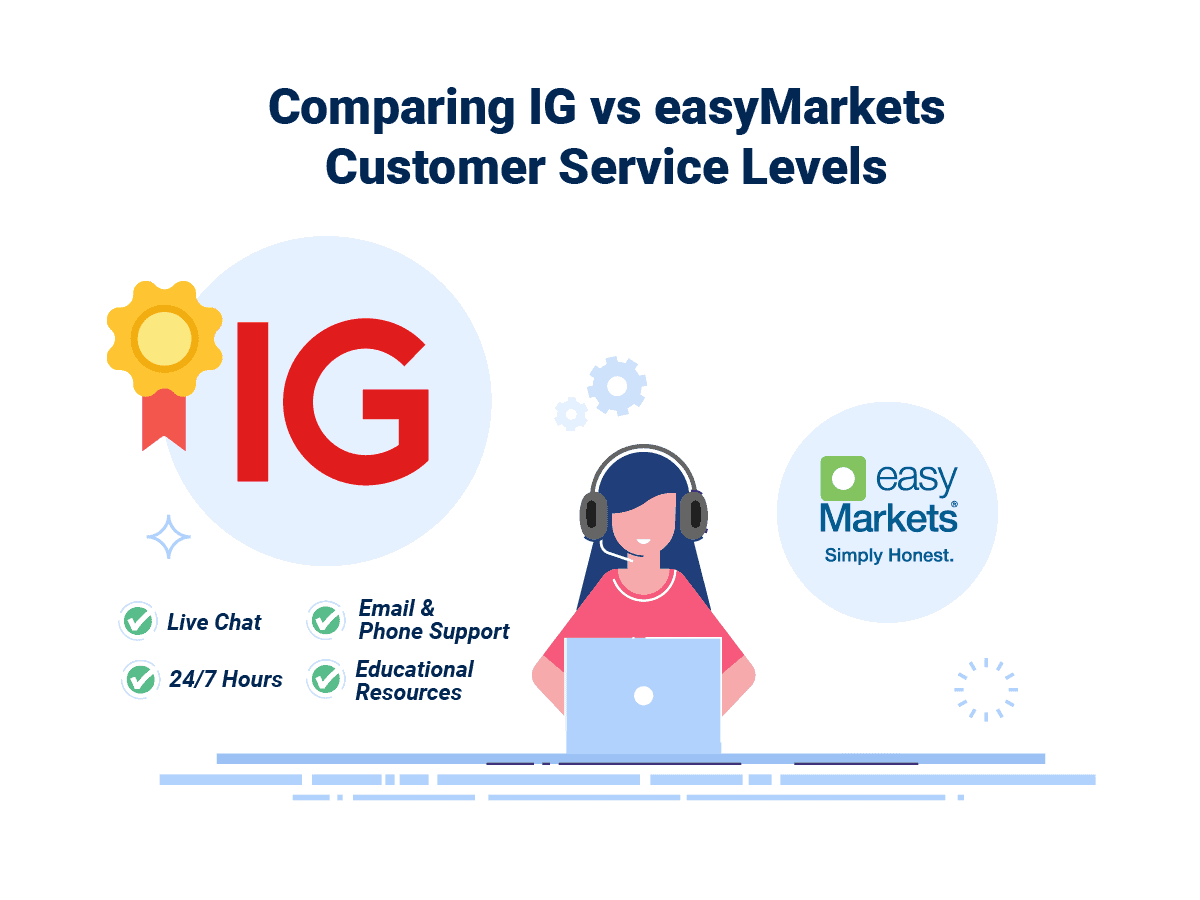

IG is one of the largest forex brokers in the world with low spreads and a range of trading platforms while easyMarkets has fixed spreads and negative balance protection, among others. Our easyMarkets vs IC comparison reviews the key features the brokers offer.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert