easyMarkets vs Plus500: Which One Is Best?

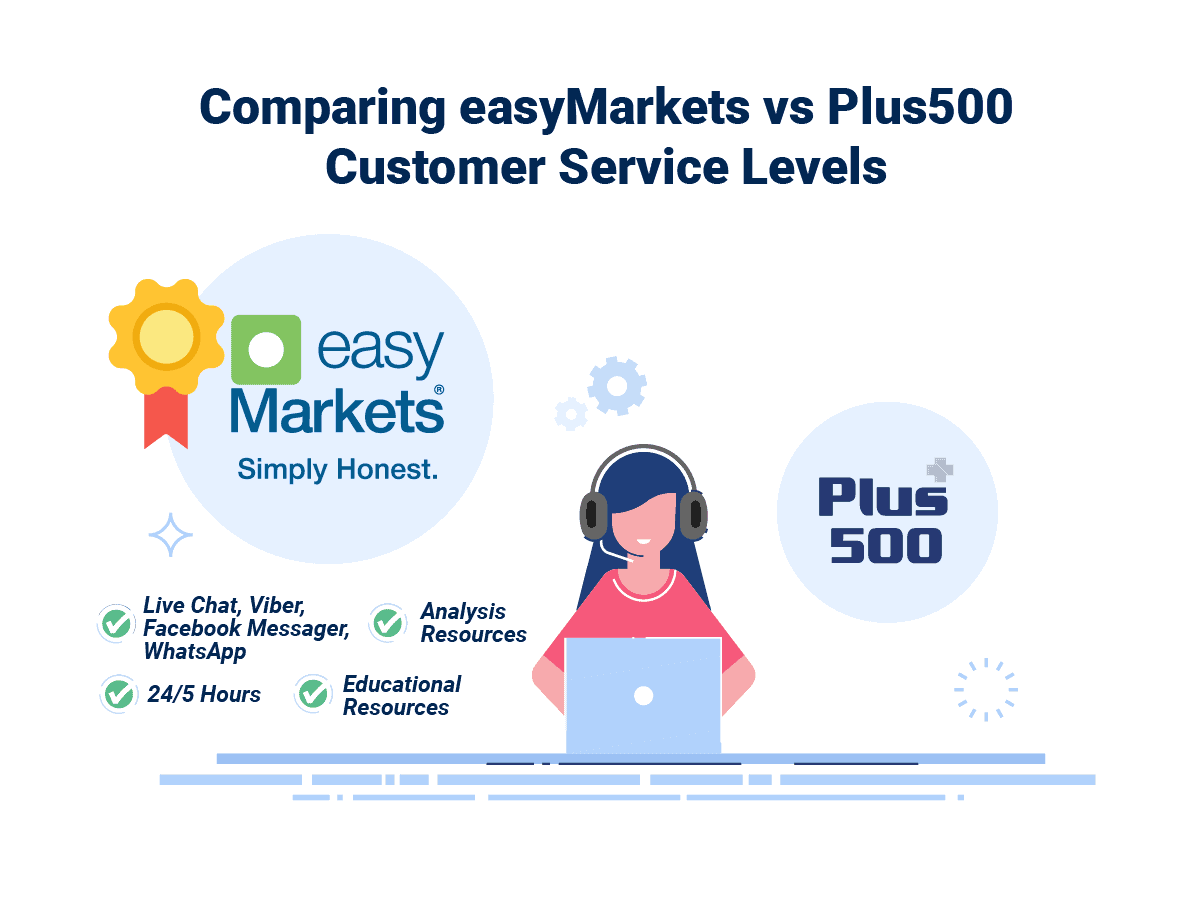

Our comprehensive comparison of easyMarkets vs Plus500 dissects key areas like trading costs, Forex trading platforms, and regulations to help you choose the right Forex broker.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

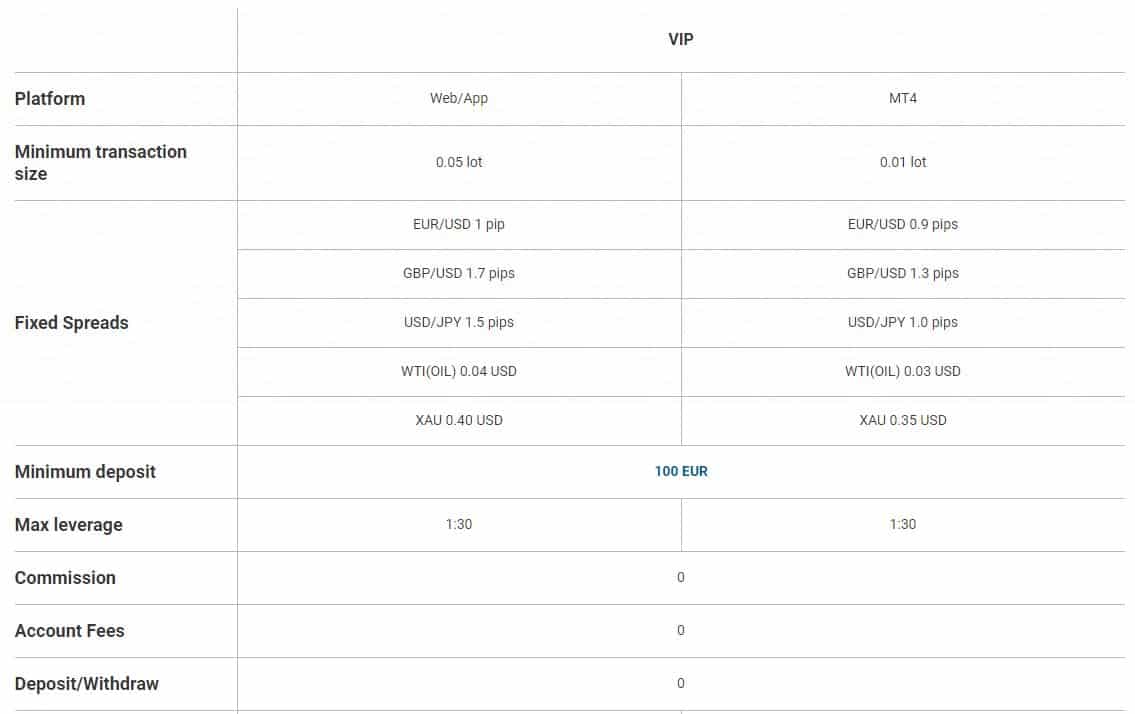

Are all of the spreads I get on EasyMarkets fixed spreads?

Yes, easyMarkets is a fixed spread broker. The broker has a reputation for keeping spreads fixed no matter how volatile market conditions are or how low liquidity is.