Raw Spread Vs Standard Account

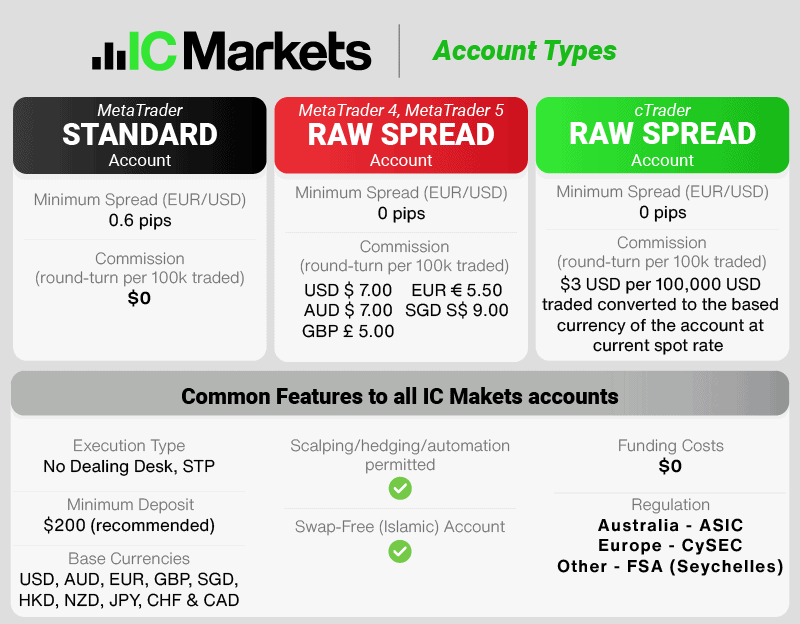

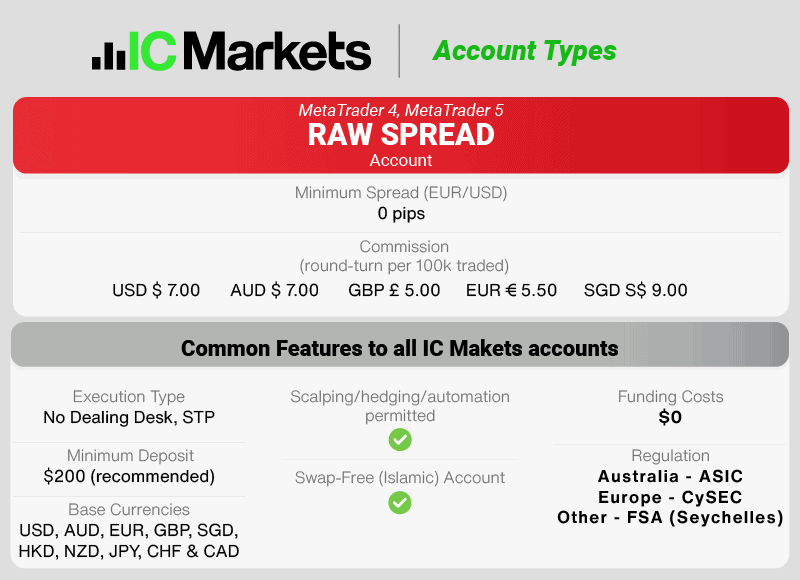

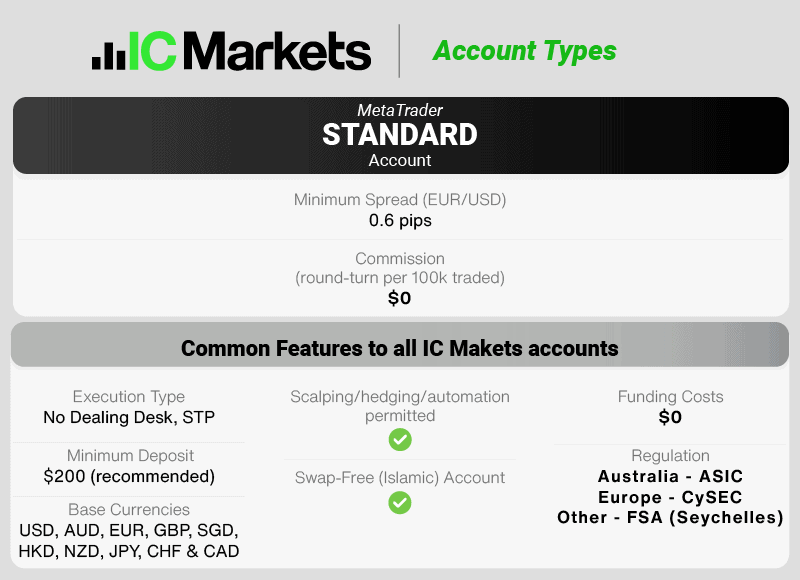

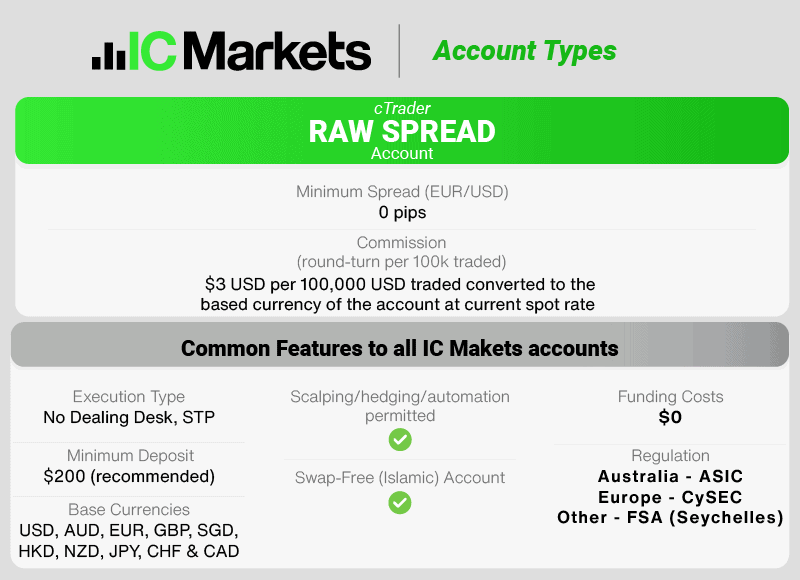

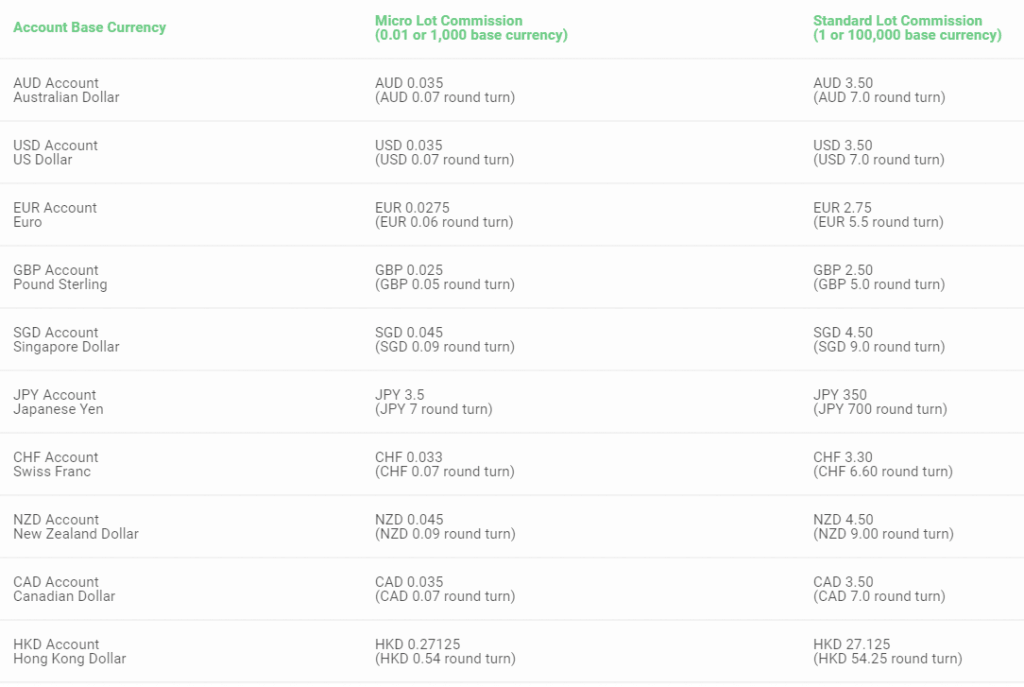

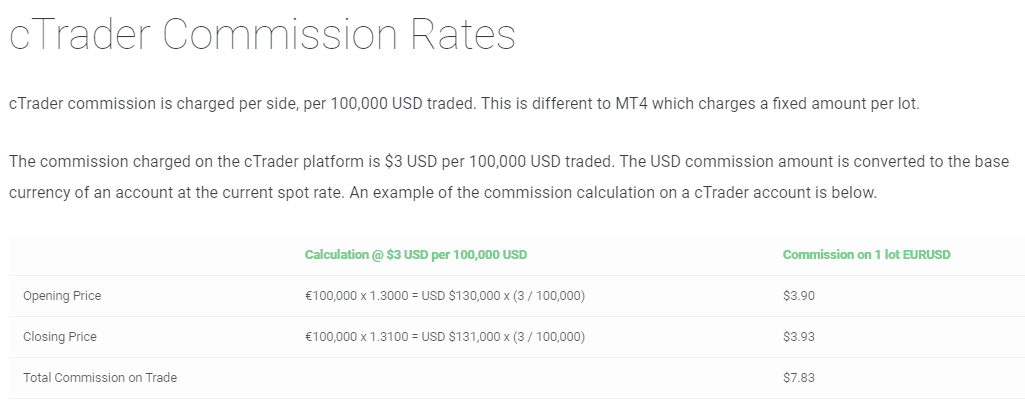

IC Markets is the lowest fee forex broker offering a Standard and Raw Spread account. The Standard account has higher spreads but no commissions, while the Raw Spread account has the tightest ECN spreads and a low commission of $3.50 per $100k traded.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Similarities Between Accounts

Similarities Between Accounts

Ask an Expert

I’m looking to trade using automation (EA Robots). Is the Raw Spread or Standard account going to result in lower fees? What do most high volume traders choose?

Most high volume traders choose the RAW Spread account as it is better for scalping. This is because the RAW spread account has priority access to the order books which results in faster speeds that allow for less slippage.

I’m based in London and was wondering what account more UK traders choose?

We believe retail traders in the UK prefer the standard account. However, most experienced traders prefer Raw account for its lower spreads

What should be my intended purpose and nature of transaction as a beginner

Obviously you trade with the intention of making some profit, however it is important to appreciate that CFD are risky instruments and using leverage can amplify your losses. As a beginner trader you should practise by using a demo account and then when you are ready to use real money, trade in small amounts with low leverage and trade in micro or minimum lots. You should also make use of the risk management tools such as stop loss orders.

IC Markets provide a range of forex trading and education tools to help you with your trading journey.

Is Raw spread good for scalping?

Scalpers like raw spreads because the cost for each trade is lower, other scalper like fixed spreads because they want predictability when trading. It depends on your trading strategy.