IC Markets vs Axi: Which One Is Best?

Our comprehensive comparison of IC Markets vs Axi dissects key areas like trading costs, Forex trading platforms, and regulations to help you choose the right Forex broker.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

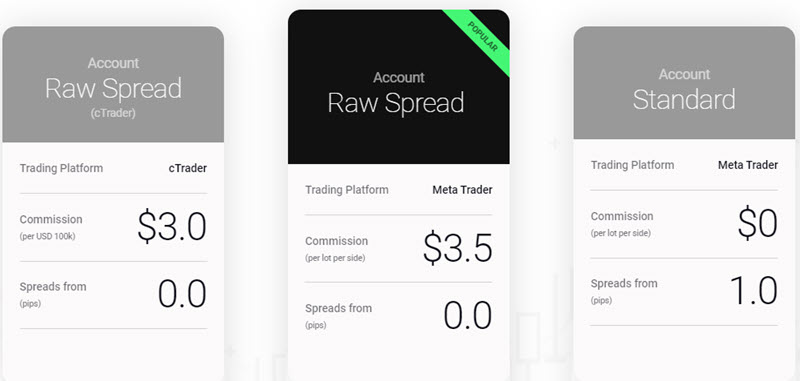

USD$3.5 commission for swap transactions for each 100k traded (when using the MetaTrader 4 platform)

USD$3.5 commission for swap transactions for each 100k traded (when using the MetaTrader 4 platform)

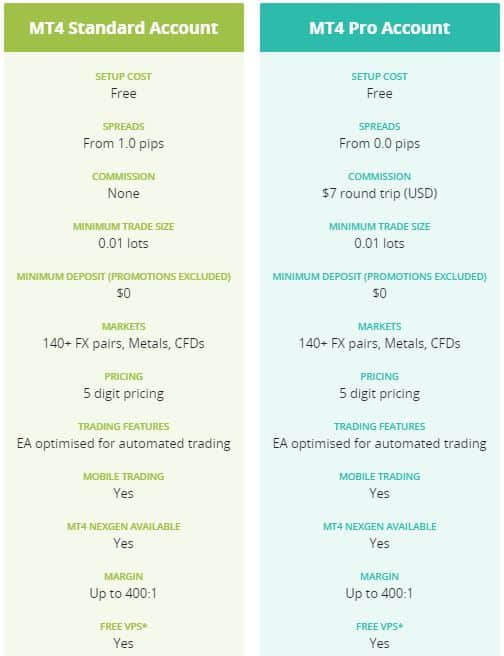

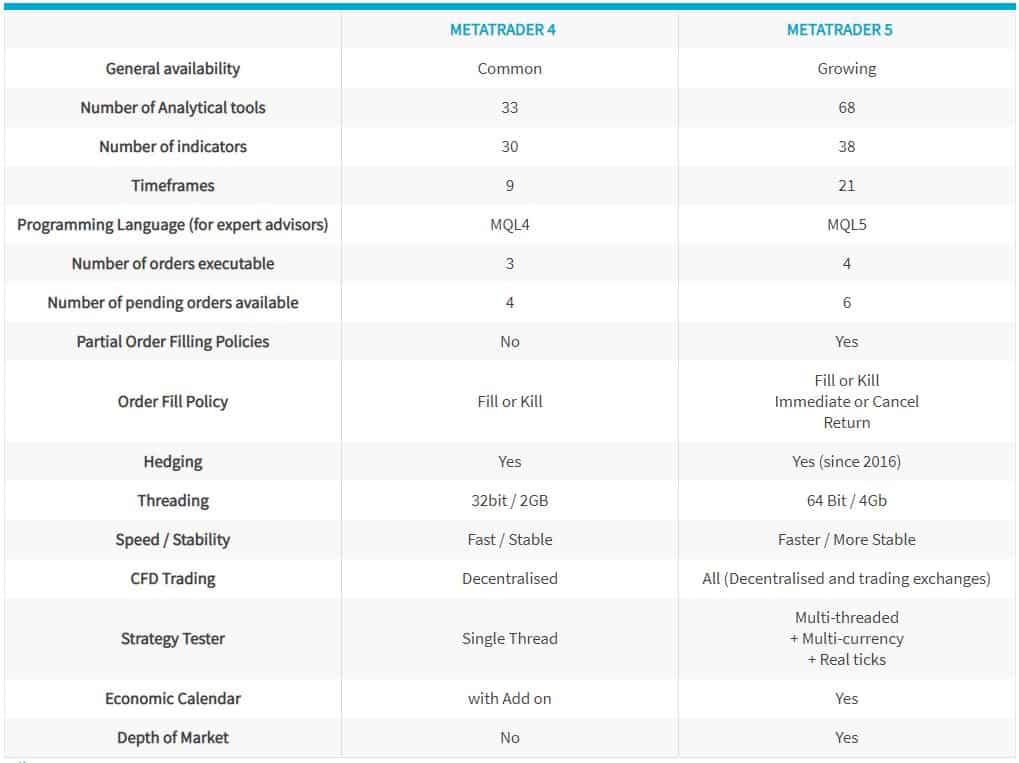

Both IC Markets and AxiTrader offer MetaTrader 4 (called MT4). IC Markets also offers MetaTrader 5 (MT5) and cTrader, while AxiTrader is an MT4 specialist.

Both IC Markets and AxiTrader offer MetaTrader 4 (called MT4). IC Markets also offers MetaTrader 5 (MT5) and cTrader, while AxiTrader is an MT4 specialist.

Ask an Expert