IC Markets vs IG: Which One Is Best?

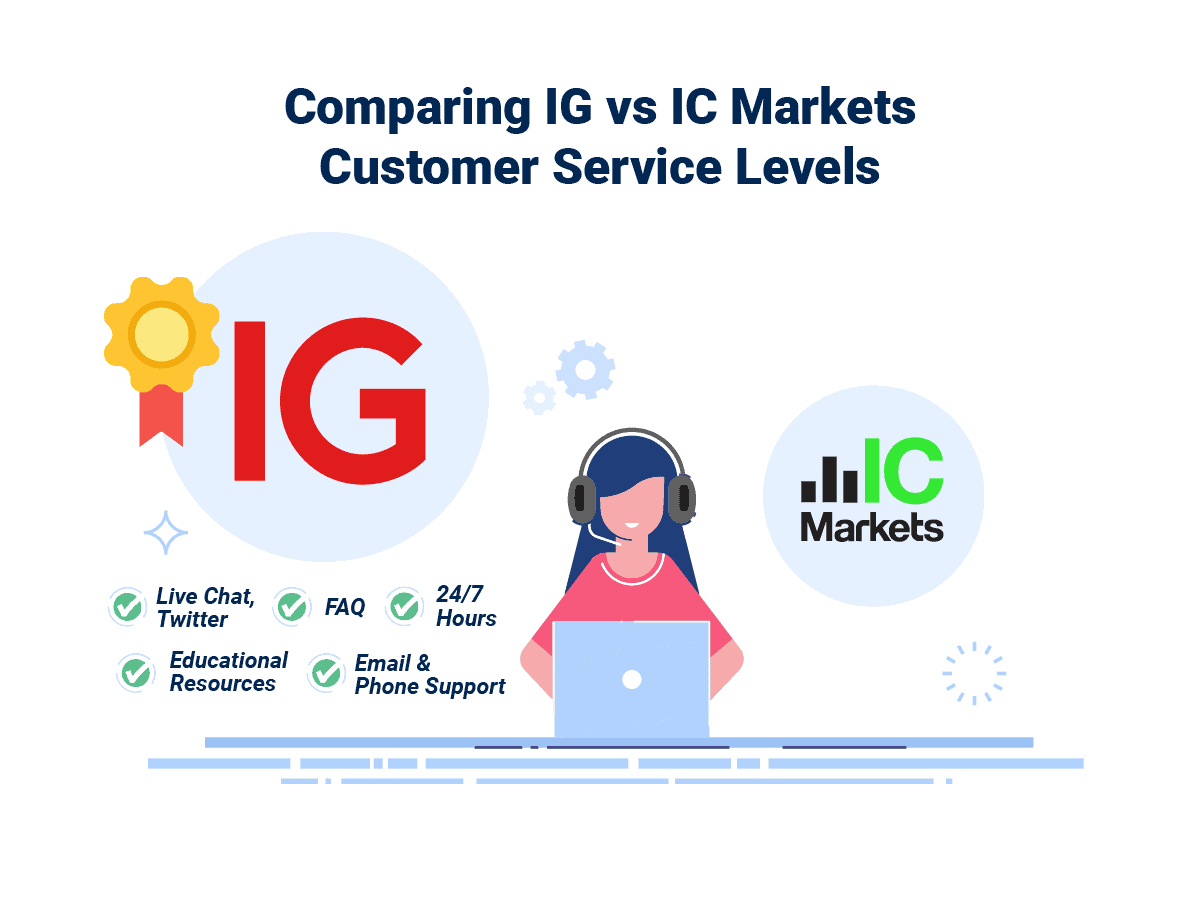

With a large market share in the forex broker space, both IC Markets and IG Group (IG) offer the leading forex trading platforms and customer support. Let’s have a closer look at both brokers.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

AVG DMA Spreads

AVG DMA Spreads

Ask an Expert