Plus500 vs City Index: Which One is Best?

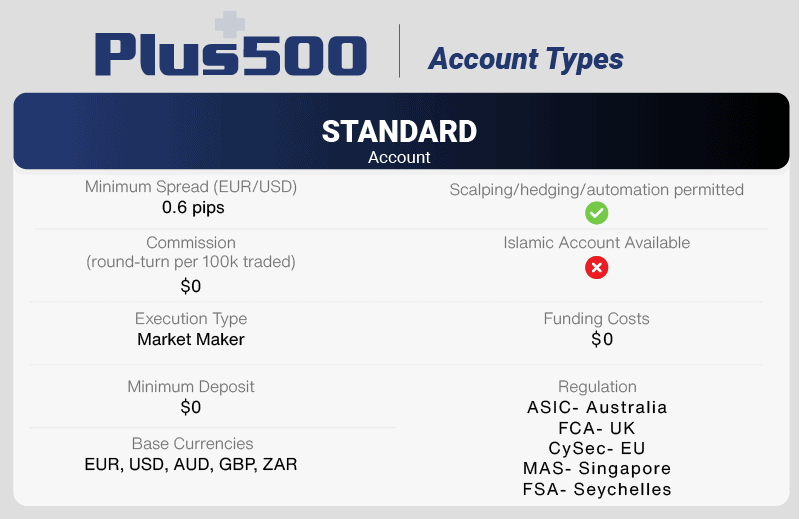

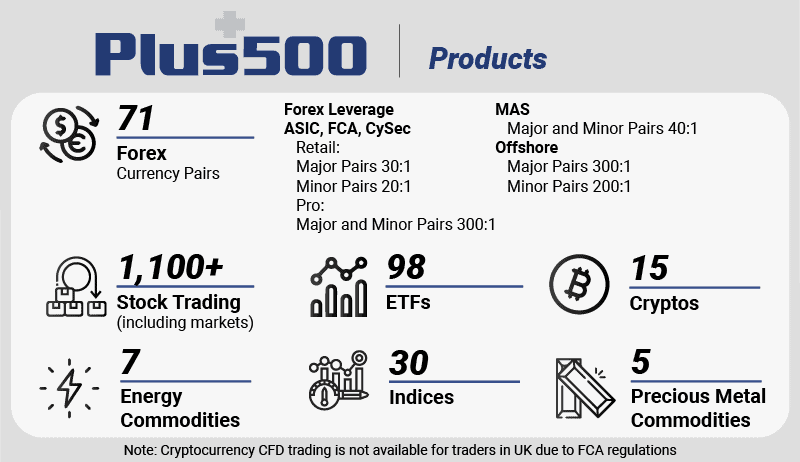

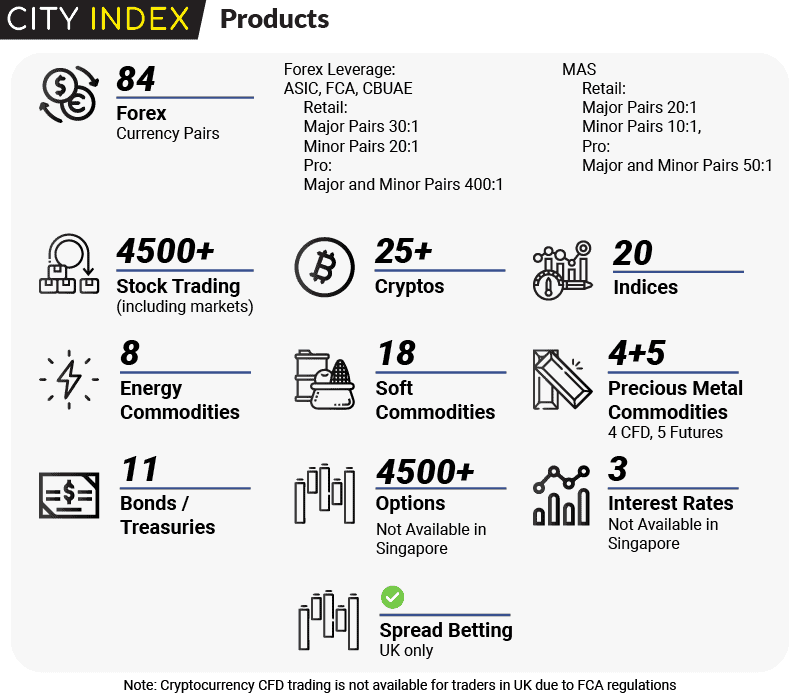

Plus500 and City Index are both market makers, so the spreads should be similar. Let’s see if this is the case, along with other key features such as leverage, risk tools, customer services and accounts, to decide which broker is best for each category.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

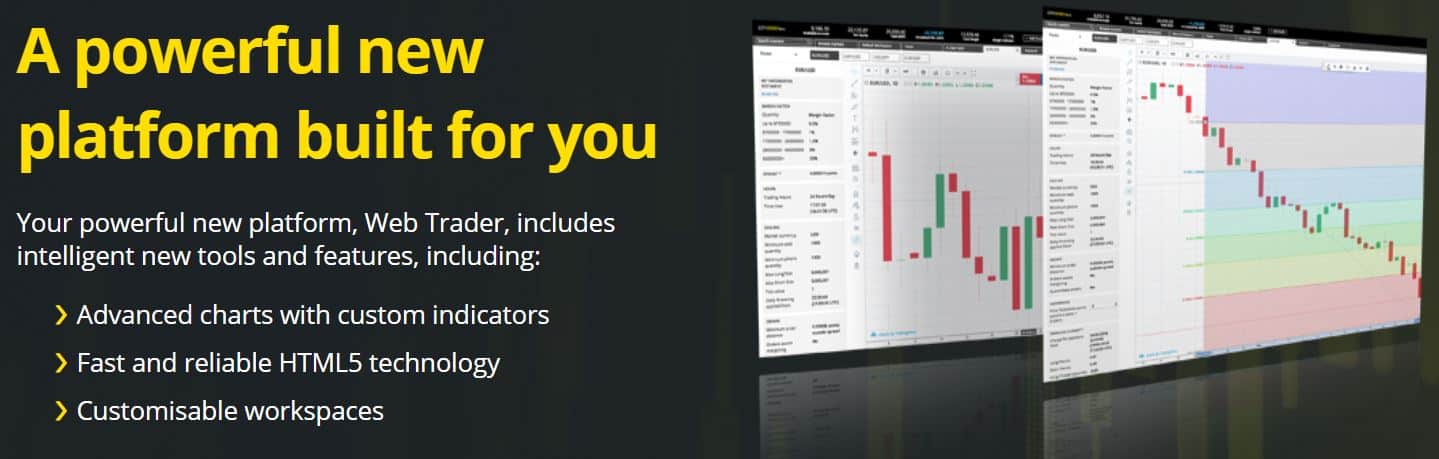

Intelligent Tools

Intelligent Tools

Disclaimer: The FCA (Financial Conduct Authority) ban on the sales of digital cryptocurrencies to retail clients prohibits UK traders from accessing these types of financial services. However, clients from Europe, Australia and the rest of the world can still trade crypto assets via their retail investor accounts.

Disclaimer: The FCA (Financial Conduct Authority) ban on the sales of digital cryptocurrencies to retail clients prohibits UK traders from accessing these types of financial services. However, clients from Europe, Australia and the rest of the world can still trade crypto assets via their retail investor accounts.

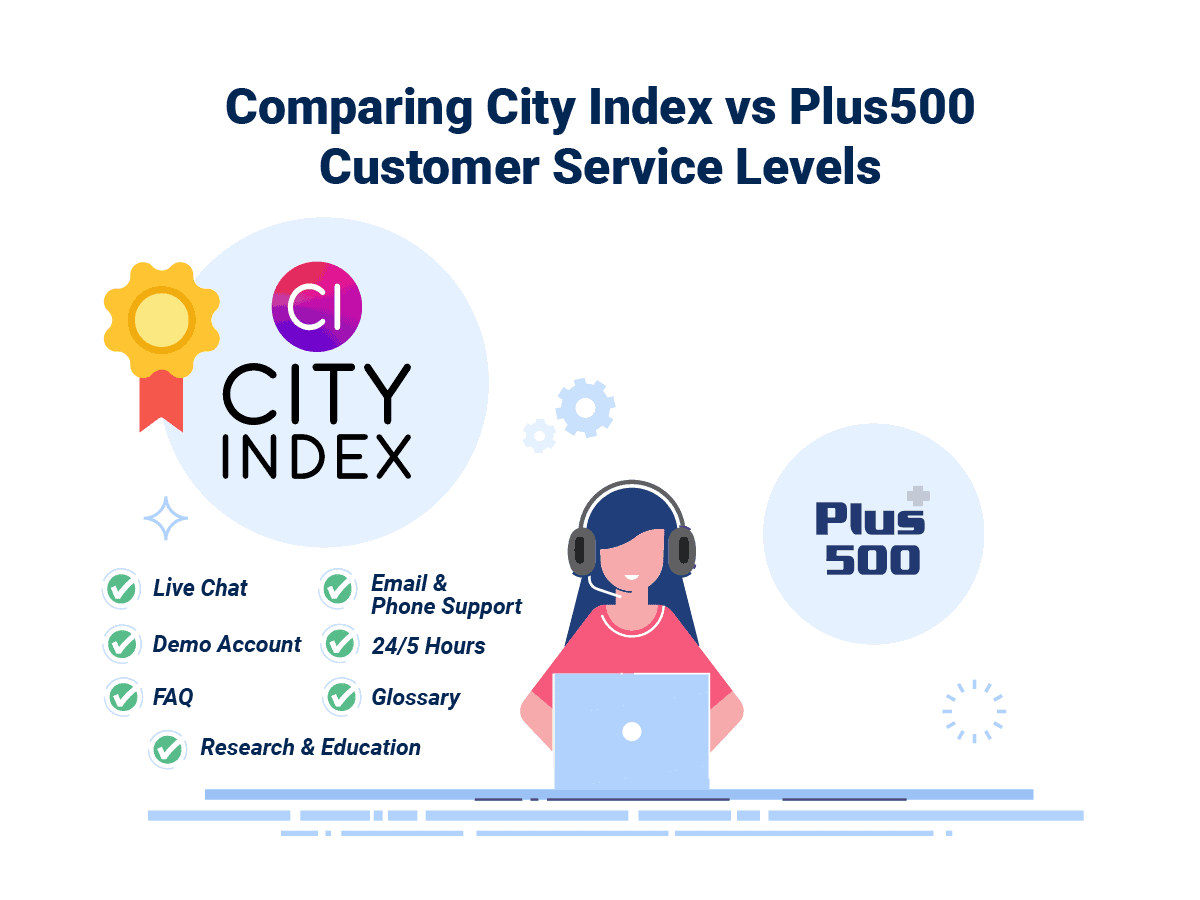

Research And Education:

Research And Education:

Ask an Expert