Plus500 vs CMC Markets: Which One Is Best?

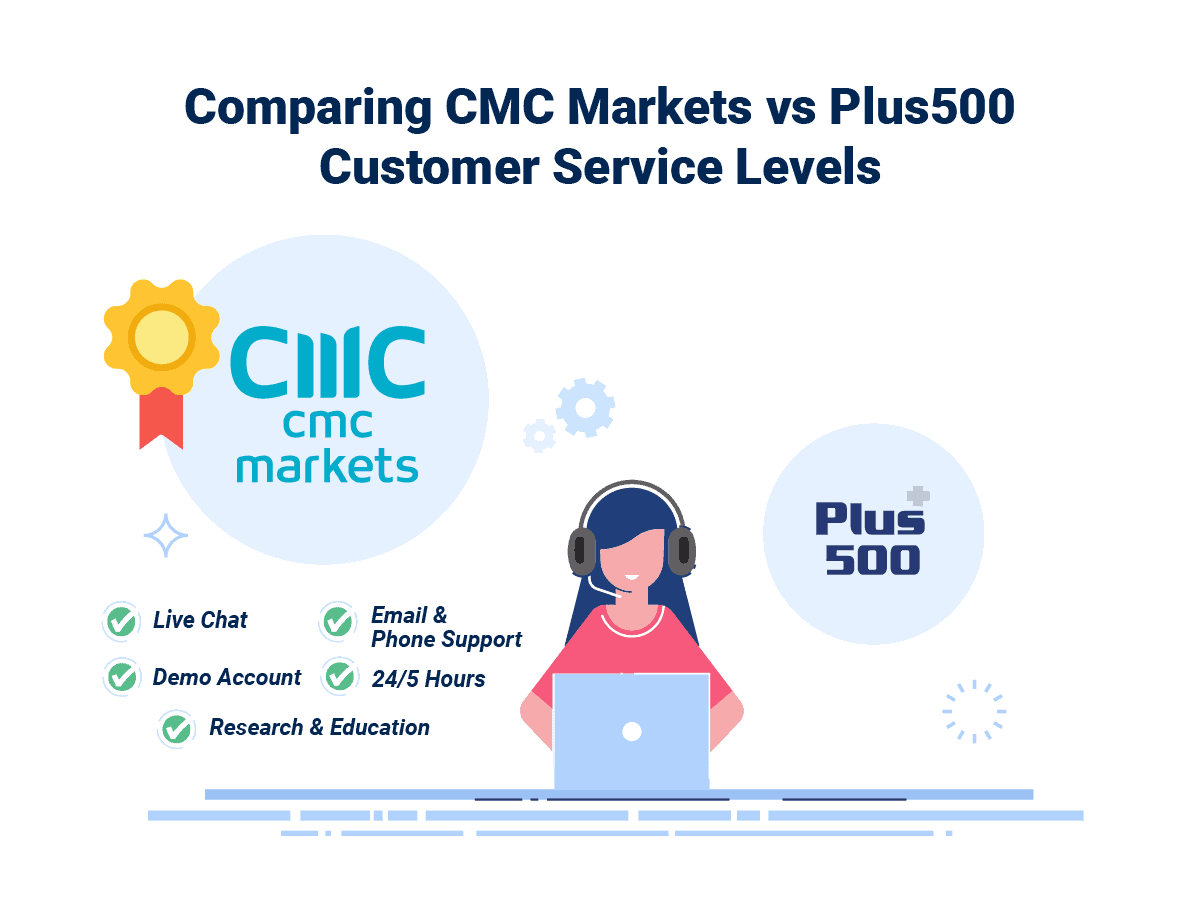

CMC Markets is a highly regarded broker for share trading, but are they better than contracts for difference (CFD) specialist Plus500? Both forex and CFD brokers offer excellent trading platforms with over 80 technical indicators and 10+ charting tools. We compare the brokers’ key trading features to establish the winning broker for 2024.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Education:

Education:

Education: CMC Markets offers a wealth of educational material, these include:

Education: CMC Markets offers a wealth of educational material, these include:

Ask an Expert