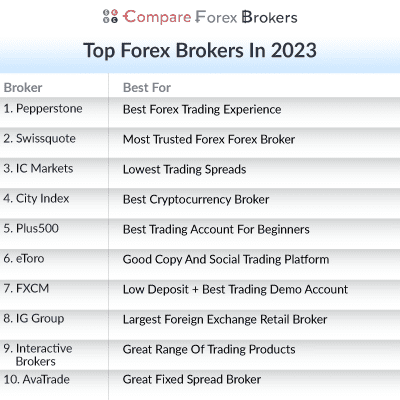

Top 5 Rated Brokers Overall

Top Rated Brokers Overall

While the best forex trading platform for a particular trader will always depend on your specific trading style, we rate the following brokers as the best of the best for their excellent trading conditions, competitive trading costs and variety of currency pairs and other trading products, such as CFDs, ETFs, stocks and spread betting.

- Pepperstone

- IC Markets

- BlackBull Markets

- Fusion Markets

- OANDA

Pepperstone claims the title Broker of the Year based on several factors, including its fast execution speeds, competitive trading costs and extensive range of financial markets to trade. This broker offers a choice of four trading platforms and offers access to over 700 CFDs and sixty currency pairs. Pepperstone account holders also benefit from award-winning customer service and excellent educational resources for beginners.

Top 5 RAW/ECN Trading Accounts

Top RAW/ECN Trading Accounts

When it comes to pricing, RAW and ECN-style trading accounts offer some of the tightest spreads on the market. Most of the brokers on this list boast minimum spreads of 0.0 pips.

- Pepperstone

- IC Markets

- Fusion Markets

- City Index

- TMGM

Pepperstone again snags the top spot for its overall low spreads. Minimums for this broker can go as low as 0.0, and the average, based on our tests, is 0.36 pips. Honourable mention goes to IC Markets, which boasts excellent spreads across all major currency pairs.

Top 5 Standard Accounts

Top Standard Accounts

Standard accounts may not have the ultralow spreads of a RAW or ECN account, but the absence of commission fees makes them an appealing option for new traders and those who prefer fixed trading costs.

- OANDA

- IG Group

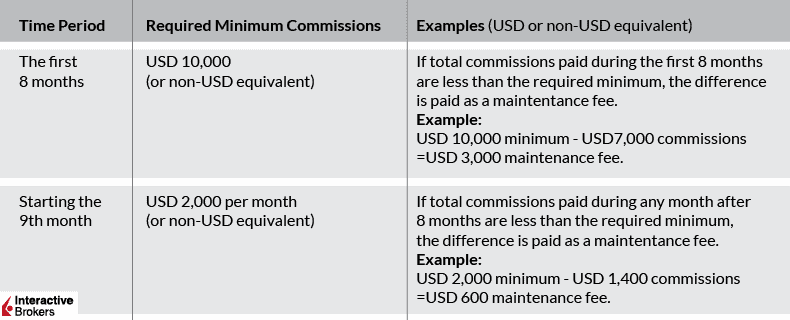

- Interactive Brokers

- CMC Markets

- Swissquote

Based on our testing, IC Markets more than earns its place at the top of this list. The broker can claim an impressively low average spread of 1.03 pips for its standard account. Runner-up CMC Markets came in only slightly higher at 1.11 pips, making either broker an excellent choice for anyone looking for predictable trading costs.

Top 5 Most Trusted Forex Brokers

Top Most Trusted Forex Brokers

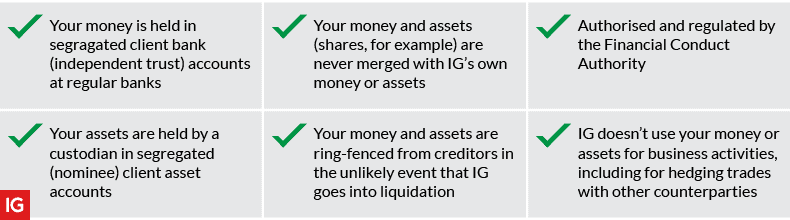

Brokers recognised in this category stand out for their commitment to investor safety and overall transparency. Most hold multiple licenses from top jurisdictions, including Australia, the UK, the USA and Europe.

- OANDA

- IG Group

- Interactive Brokers

- CMC Markets

- Swissquote

OANDA claims the top spot due to a record number of licenses from regulators around the world. Most significantly, the broker has the stamp of approval from five Tier-1 jurisdictions: Australia, the USA, the UK, Canada and Singapore. With 17 years of experience in the forex industry, this broker has the right to rest on its reputation.

Top 5 Brokers For Fast Execution Speed

Top Brokers For Fast Execution Speed

In volatile markets, execution speeds can mean the difference between a big win and a huge one. The brokers below help you avoid the pitfalls of market gaps and slippage for trades that execute at the quoted prices you need.

- BlackBull Markets

- Pepperstone

- Fusion Markets

- Axi

- TMGM

If we had to describe BlackBull Markets’ execution speeds in one word, that word would be ‘blistering.’ This broker blew the competition out of the water in our tests, clocking in at just over 50 ms for limit orders and just under 100 ms for market orders.

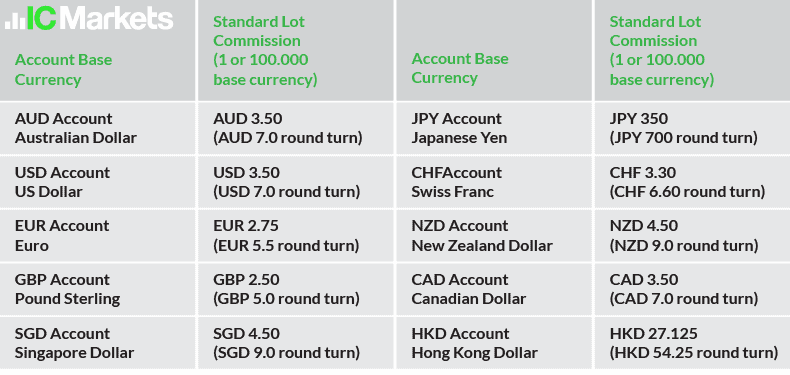

Top 5 Brokers For Low Commission

Top Brokers For Low Commission

What goes well with tight minimum spreads? Low commissions? The following brokers earned top marks for controlled commissions that help you maximise your profits.

- Fusion Markets

- Pepperstone

- FP Markets

- IC Markets

- GO Markets

We awarded Fusion Markets the top spot for consistently excellent performance across currencies in our tests. Whether you denominate your account in Australian dollars, American dollars, British pounds or euros, this broker sits in the top five for lowest commissions.

Top Brokers For Cost

Top Brokers For Cost

While some brokers can boast low spreads and others claim low commissions, these brokers offer some of the best possible pricing with account types that feature both competitive minimum spreads, low commissions and minimal indirect costs.

- Fusion Markets

- Accendo

- Fondex

- IC Markets

- Vantage FX

With no minimum deposit, no withdrawal fees and no inactivity fees, Fusion Markets offers an excellent trading experience for those on a budget. The 0.18 RAW and 0.9 standard account spreads don’t hurt, either.

Top 5 Trading Experience

Top Trading Experience

A great trading experience encompasses seamless platform functionality, excellent trading tools, fast execution and competitive pricing. Of all the brokers we trialled this year, the following ten offered the most comprehensive collection of trading features.

- BlackBull Markets

- Pepperstone

- Fusion Markets

- FxPro

- City Index

BlackBull Markets earned top marks for solid trading conditions, accessible trading platforms and excellent customer service. This broker’s execution speeds handily beat the competition, and it boasts an impressive selection of ways to trade: MetaTrader 4, MetaTrader 5, cTrader, TradingView and BlackBull Trader. Account holders also praise BlackBull for its friendly, accessible and knowledgeable customer support representatives.

Top 5 Brokers For Customer Service

Top Brokers For Customer Service

Even the most experienced traders need someone to lean on when it comes to technical questions or account difficulties. In those moments, these brokers stand ready to assist with a comprehensive array of human and bot-driven support.

- Pepperstone

- FP Markets

- Eightcap

- City Index

- OANDA

Our choice for best customer service goes to Pepperstone. No surprise since this broker has a shelf full of trophies for its customer support, including 11 awards from Investment Trends. In addition to human-powered live chat and email channels, the broker guarantees that your questions will be answered by trained representatives with trading and platform-specific experience.

Top 5 Brokers For Education

Top Brokers For Education

Though particularly important for beginners, solid education resources benefit traders of all experience levels. These brokers continue to develop new tools to improve your trading, from step-by-step guides to webinars.

- CMC Markets

- Eightcap

- IG Group

- Interactive Brokers

- FOREX.com

From market research tools to a library of guides on trading topics to instructions on how to best leverage platform features and regular live webinars, CMC Markets has the tools any online trader needs to take their trading to the next level.

Top 5 ASIC-Regulated Brokers

Top ASIC-Regulated Brokers

The following brokers, all of which hold an Australian Financial Services License (AFSL) issued by the Australian Securities and Investments Commission (ASIC), provide a superior trading environment to traders Down Under.

- Pepperstone

- IC Markets

- Fusion Markets

- OANDA

- FP Markets

Top 5 FCA-Regulated Brokers

Top FCA-Regulated Brokers

These award winners, licensed and regulated by the UK’s Financial Conduct Authority (FCA), offer a superior trading experience for residents of Great Britain and Northern Ireland.

- Pepperstone

- OANDA

- Eightcap

- IG Group

- Admirals

Top 5 CySEC Regulated Brokers

Top CySEC Regulated Brokers

For traders in Europe, these brokers offer attractive combinations of top trading platforms, high leverage, tight spreads and powerful trading tools. Each broker on this list holds a license from the Cypress Securities and Exchange Commission (CySEC) and is authorised to operate throughout the EU.

- Eightcap

- FP Markets

- Pepperstone

- IC Markets

- Admirals

Top 5 US-Regulated Brokers (NFA, CFTC)

Top US-Regulated Brokers (NFA, CFTC)

American traders interested in trading forex may have fewer brokers from which to choose but won’t want for quality. The top brokers licensed by the National Futures Association (NFA) and the Commodities Futures Trading Commission (CFTC) all offer attractive pricing with low trading costs, quality risk management tools and a respectable selection of trading products.

- OANDA

- FOREX.com

- IG Group

- Interactive Brokers

- TD-Ameritrade

Top 5 UAE-Regulated Brokers (DFSA, ADGM, SCM)

Top 5 UAE-Regulated Brokers (DFSA, ADGM, SCM)

If you’re ready to start trading and based in the Middle East, these brokers licensed by the UAE’s Dubai Financial Services Authority (DFSA) or the Abu Dhabi Global Market (ADGM) provide low trading costs, superior trading tools and a wide variety of financial products you need for an excellent trading experience.

- Pepperstone

- AvaTrade

- IG Group

- Axi

- XTB

Top MAS-Regulated Brokers

Top MAS-Regulated Brokers

For traders based in Asia, an Fx broker regulated by the Monetary Authority of Singapore provides the peace of mind that comes from trading with a licensed, transparent online broker. The following represent the best of MAS-regulated brokers based on our analysis.

- FP Markets

- Eightcap

- Pepperstone

- City Index

- IG Group

Top CIRO Forex Brokers

Top CIRO Forex Brokers

Canadians in search of excellent trading conditions and competitive trading costs should consider these brokers, all of which hold licenses from the Canadian Investment Regulatory Organisation (CIRO).

- OANDA

- Forex.com

- CMC Markets

- AvaTrade

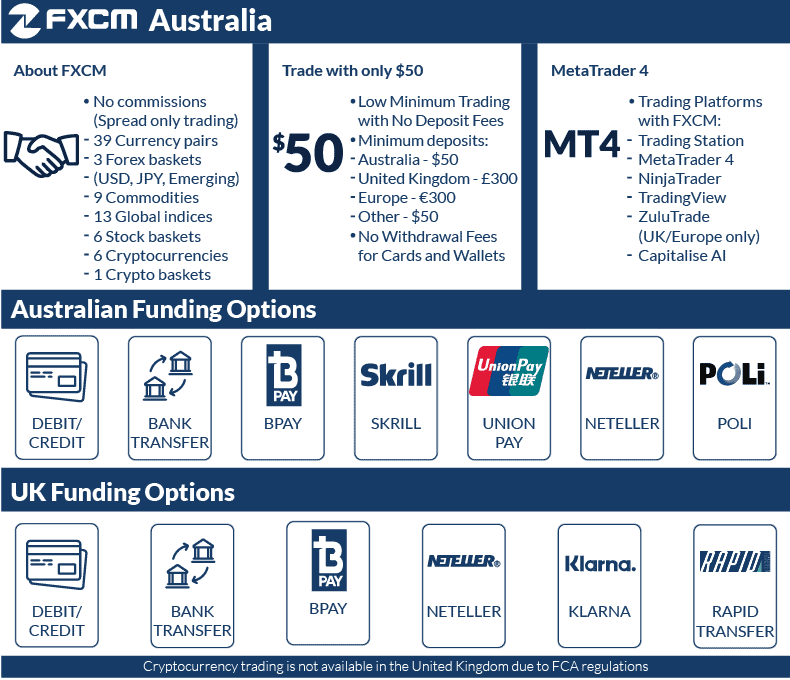

- FXCM

Top 5 MT4 Brokers

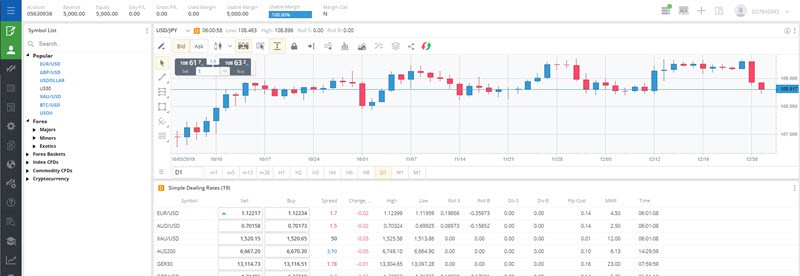

Top MT4 Brokers

First released in 2005, MetaTrader 4 remains the undisputed best trading platform for trading forex. With a vast library of technical indicators for advanced market analysis and decades of historical data for backtesting strategies, it provides a tailored forex experience like no other. The following brokers have partnered with MetaTrader to offer a tailored experience catering to forex traders.

- Pepperstone

- IC Markets

- Eightcap

- BlackBull Markets

- Axi

Top 5 MT5 Brokers

Top MT5 Brokers

With many of the same powerful features as MetaTrader 4, along with access to centralised exchanges, MetaTrader 5 expanded the reach of online traders around the world. If you’re interested in diversifying your portfolio with exchange-traded financial products such as stocks and futures, have a look at these brokers.

- IC Markets

- Pepperstone

- FP Markets

- BlackBull Markets

- Fusion Markets

Top 5 TradingView Brokers

Top 5 TradingView Brokers

This combination analytical platform, mobile trading app and social network for traders offers some of the most advanced charting tools we’ve encountered. Unique features, like stock, forex and cryptocurrency screeners, give TradingView an edge with experienced technical traders. The below brokers offer at least one account that supports TradingView.

- Eightcap

- Pepperstone

- OANDA

- City Index

- FXCM

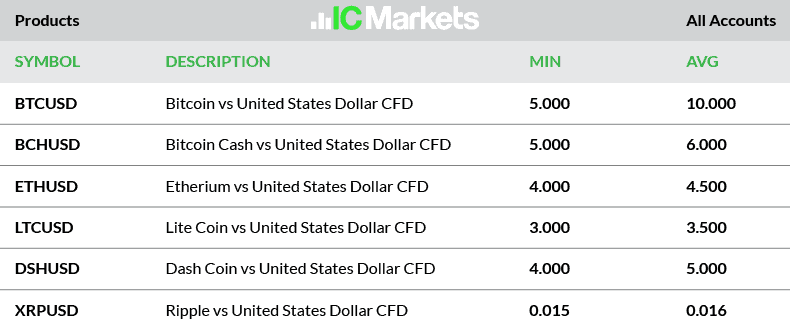

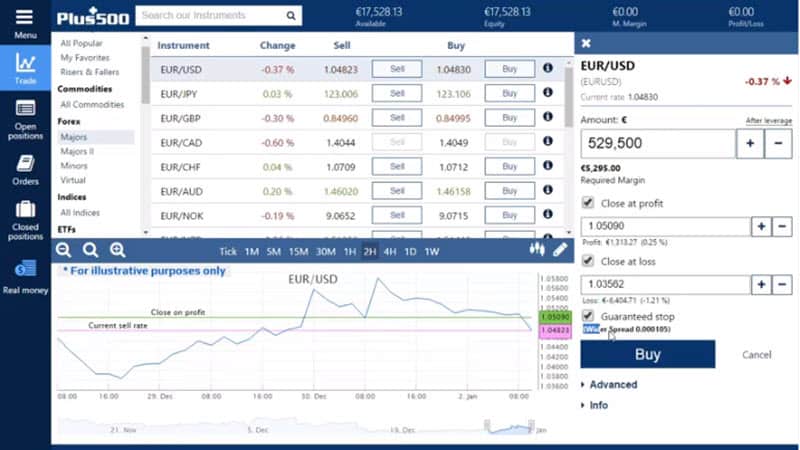

Top 5 Brokers For Crypto CFDs

Top Brokers For Crypto CFDs

If you’re a cryptocurrency enthusiast, you understand that trading crypto CFDs comes with some additional challenges. These brokers provide a trading environment tailored to the specific needs of crypto derivatives trading, from a wide range of tokens to trade to alternative account funding and withdrawal options that link to your crypto wallet.

- Eightcap

- eToro

- Plus500

- AvaTrade

- IC Markets

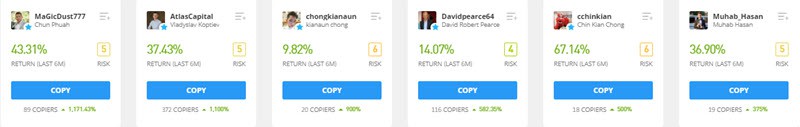

Top 5 Brokers For Social Trading/Copy Trading

Top Brokers For Social Trading/Copy Trading

Interested in trading forex or CFDs but looking for a lighter experience? These brokers allow you to mimic the positions of experienced traders and crowd-source your next trading strategy. Social and copy traders will appreciate the pared-down, gamified investing experience available with these brokers.

- eToro

- Pepperstone

- BlackBull Markets

- FXCM

- FP Markets

Top 5 Brokers For Automation

Top Brokers For Automation

Whether you code your own trading bots or like to experiment with MetaTrader’s Expert Advisors, these brokers offer the platforms and integrations you need to automate your trading workflow from strategy design to execution.

- Fusion Markets

- Pepperstone

- BlackBull Markets

- FXCM

- FP Markets

Ask an Expert

Which of the brokers can I use in Australia?

All brokers on this list are ASIC regulated meaning you can use them in Australia

Thanks for this comprehensive review. It is very helpful. I have to take exception to your statement regarding IG and scams. They are shonky. I have been suspended by them 4 times, one as recently as January 2023 because I am a profitable trader (and they act as Principal). This is unethical. I am now skeptical of all brokers – and am looking for a backup broker (CFD’s Australia – SPI and DAX) as mine currently INCREASES their spread once I am in the trade (Finalto). Anyway – just letting you know about IG – I couldn’t let your comment stand. Yet thanks for the great reviews. Regards. Matt.

Hi Zero, thank for your reply. IG is a Market maker which means it is not in their interest to be your counter-party on losing trades. You will find this to be the case with most market makers, our advise is to look at a no dealing desk broker since they do not review the trades but instead let you deal with the liquidity providers directly.