IG Group Broker Review

IG is the largest retail forex broker with solid reviews, a range of markets including forex, CFD and shares combined with competitive spreads and the choice of trading platforms. Learn more about the broker and how it stacks up to the market leaders.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Account Types

Account Types

Spreads

Spreads

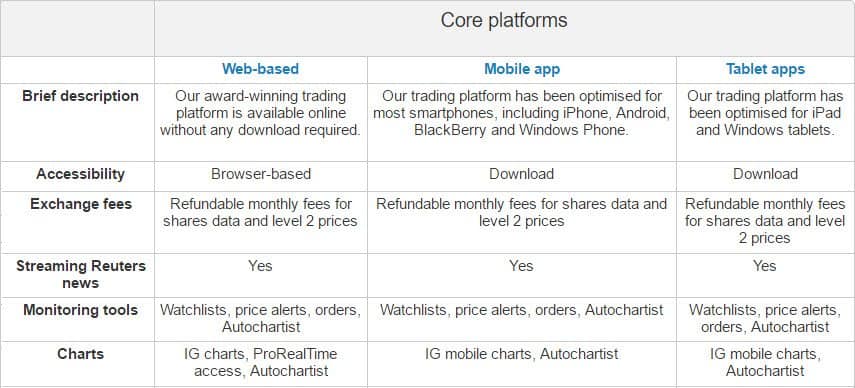

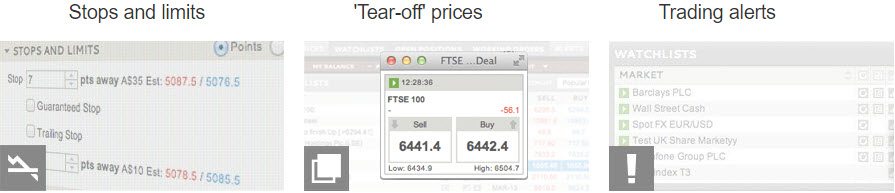

Trading Platforms

Trading Platforms

Customer Support

Customer Support

Minimum Deposit

Minimum Deposit

Forex Pairs + CFDs

Forex Pairs + CFDs

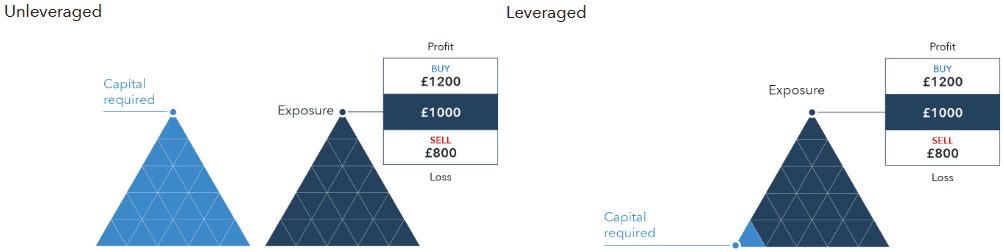

Leverage

Leverage

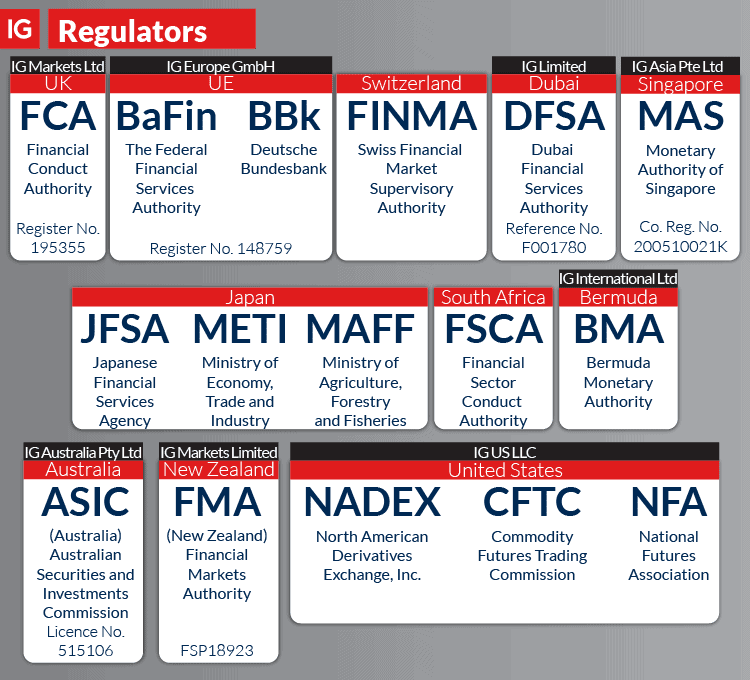

Regulation

Regulation

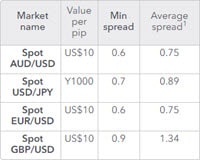

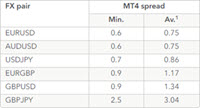

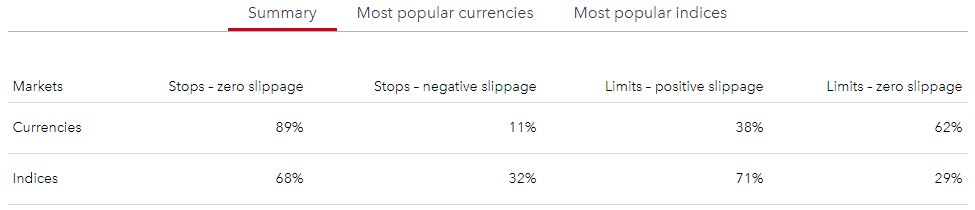

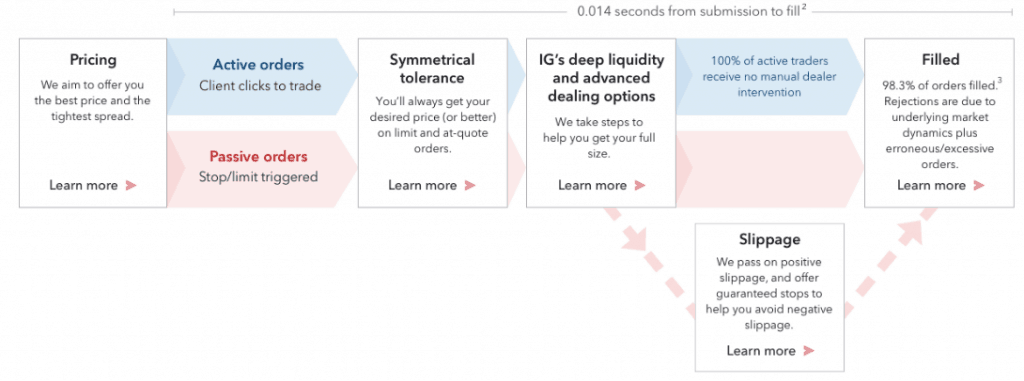

1) IG Forex Spreads – Standard Trading Execution

1) IG Forex Spreads – Standard Trading Execution

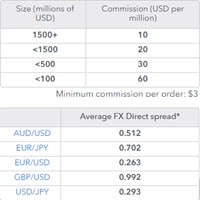

1) L2 Dealer

1) L2 Dealer 3) MetaTrader 4

3) MetaTrader 4

1) Stock Exchanges Available

1) Stock Exchanges Available

You can view our

You can view our

Ask an Expert

I see IG is a Market Maker, What does this mean?

A market maker is your counter-party to your trades. This means the broker takes the opposite position to your trade. So if you are buying, then the market maker is selling.

This is different from a no dealing desk broker who connects you with liquidity providers and have no involvement in your trade.

Can you explain what DMA trading is and if i should use it?

DMA stands for Direct Market Access. It means you have access to the order books at the exchange centres. While in theory, it means you can choose the cheapest prices available in the book, it takes a very skilled trader to take advantage of this and very few brokers offer DMA to retail traders.

How long do IG withdrawals take?

Depends on your withdrawal method